#QuickBiteCompliance Day 115

🚨 The Danger of False Negatives in Financial Crime 🚨

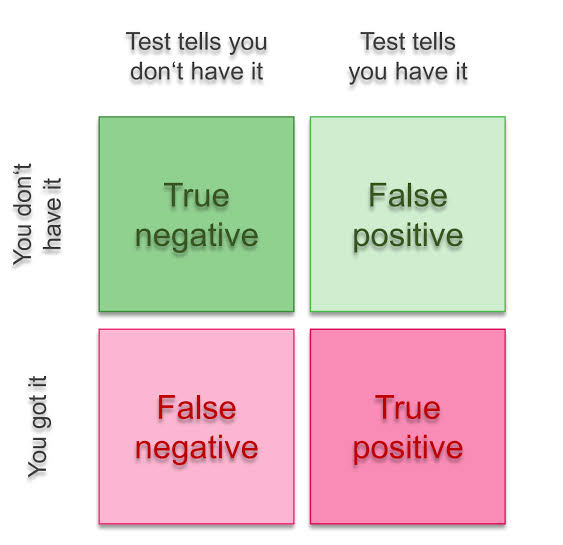

Imagine a security guard at a school entrance checking names on a “do-not-enter” list. A bad guy walks up, but because his name is slightly different or misspelled, the guard lets him in. That’s a false negative—a dangerous mistake that allows the wrong person through!

The same thing happens in financial crime. Banks and companies use screening tools to stop criminals from moving dirty money. But if the system is too strict or not smart enough, it misses real threats. Here’s how bad actors take advantage:

🔍 Fake Names & Spelling Tricks – A criminal named “John Smith” is on a sanctions list, but he registers as “J. Smith” or “Jon Smythe” to sneak past filters.

💰 Splitting Transactions – A bad guy knows that big money transfers get flagged, so he sends smaller amounts below the detection limit.

🌎 Using Middlemen – Instead of sending money directly, criminals use friends or fake businesses to move cash unnoticed.

False negatives let criminals launder money, fund illegal activities, and even support terrorism without getting caught. That’s why better screening systems and smarter controls are critical in fighting financial crime!

#FinancialCrime #AntiMoneyLaundering #Sanctions #FraudPrevention #AML #Compliance #RiskManagement #KnowYourCustomer #FalseNegatives #CrimeFighters #InclusiveRegtech #OpenSourceAML

Source: https://www.acams.org/en/resources/aml-glossary-of-terms