#QuickBiteCompliance Day 56

What’s a Concentration Account? Let’s Make It Simple!

Imagine if all the money from your class lemonade stands was mixed together in one big jar. You wouldn’t know who sold what or how much each person earned—it’s all just in there. That’s kind of how a concentration account works!

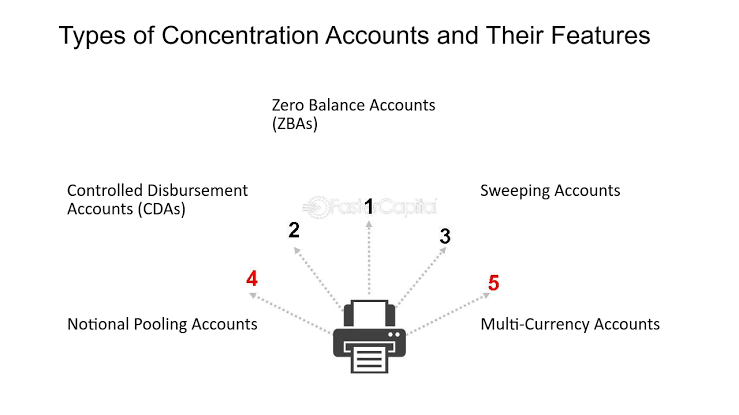

Banks use these accounts (sometimes called omnibus accounts) to make things like transfers and payments quicker. They combine money from many places into one account to keep everything organized.

But here’s the twist… bad guys LOVE these accounts. Why?

Because the money gets mixed up, and it’s harder to see where it came from! Here’s how they use it for financial crime:

Hiding stolen money: Criminals sneak dirty money into these accounts, making it harder for investigators to figure out where it came from.

Moving illegal funds: They use concentration accounts to shuffle money quickly between banks or countries, avoiding detection.

Masking identities: Since these accounts don’t show who’s behind each transaction, it’s easier for bad actors to stay hidden.

💡 Why This Matters:

While concentration accounts are helpful for banks, they need to be watched carefully. Without proper controls, they can become a playground for criminals!

We need smarter systems and stronger rules to keep bad guys out and protect our global financial system.

#AntiFinancialCrime #AML #Compliance #FinancialTransparency #BankingSecurity #FinancialCrimePrevention #MoneyLaundering #ConcentrationAccount

Source: https://www.acams.org/en/resources/aml-glossary-of-terms