#QuickBiteCompliance Day 70

How Criminals Use Large Cash Transactions to Hide Their Tracks (And How We Fight Back!)

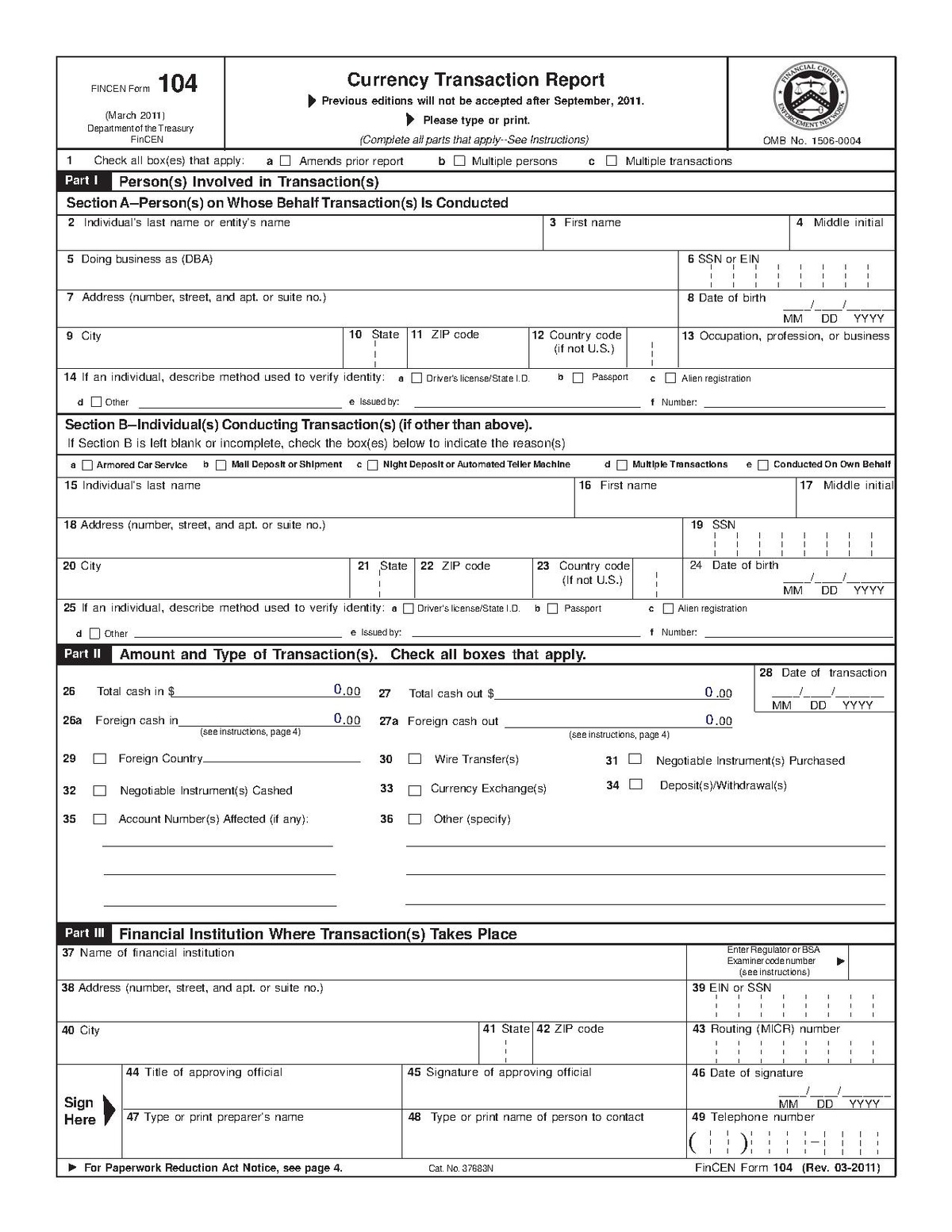

Did you know that when someone brings a lot of cash—like over $10,000 in the U.S.—to a bank, the bank has to tell the government about it? This is called a Currency Transaction Report (CTR). It helps stop bad guys from using banks to do sneaky things with money.

But here’s the tricky part: criminals don’t like leaving clues. So, they try to avoid CTRs by doing things like:

1️⃣ “Smurfing” – Breaking up big piles of cash into smaller amounts and having lots of people deposit it into different accounts.

2️⃣ Fake businesses – Pretending they’re running a real company while using dirty money from illegal activities.

3️⃣ Multiple trips – Depositing just under the $10,000 limit at different banks or on different days.

Why does this matter? Because without CTRs, it’s harder to catch money from things like illegal drugs, human trafficking, or other crimes.

Banks and governments work together to stop this. By filing CTRs and spotting suspicious patterns, they make it harder for the bad guys to hide.

💡 Want to make a difference? Keep learning about how financial systems fight crime. Knowledge is power!

#AntiFinancialCrime #FinancialIntegrity #AML #BankingCompliance #StayAlert #InclusiveRegtech #OpenSourceAML

Source: https://www.acams.org/en/resources/aml-glossary-of-terms.