#QuickbiteCompliance day 249

🚨 Breaking Down “Smurfing” – The Sneaky Money Laundering Trick! �💵

Ever heard of smurfs? No, not the cute blue cartoon characters—these are the bad guys who help criminals hide dirty money! 💸

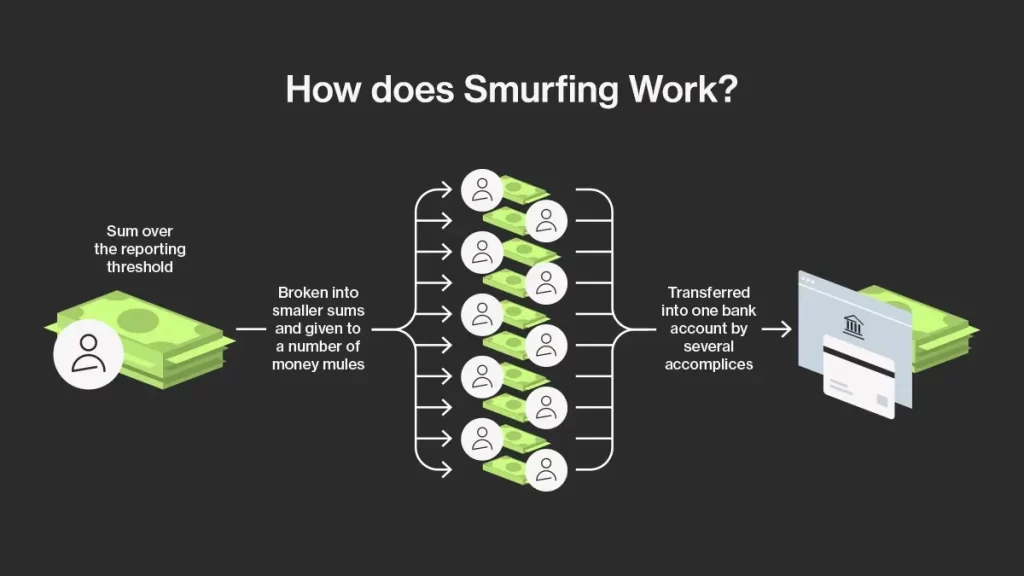

How does it work?

Imagine a thief has a huge pile of cash from illegal activities. If they deposit it all at once, banks will get suspicious. So instead, they hire a bunch of people (smurfs) to make small deposits or buy money orders—all under the radar (usually below $10,000 to avoid reporting).

Real-World Example:

A drug cartel wants to clean $500,000. Instead of depositing it in one go, they spread it across 50 people, each depositing $9,500 in different banks. By staying under the reporting limit, they fly under the radar!

Why is this dangerous?

– Helps criminals disguise illegal money as “clean” 💰

– Makes it harder for banks & regulators to track suspicious activity 🔍

– Funds terrorism, drugs, and other crimes 🚨

How do we fight it?

✅ AI & Transaction Monitoring – Detects unusual patterns (lots of small deposits).

✅ Strict AML Rules – Banks must report suspicious activity.

✅ Public Awareness – Knowing these tricks helps stop them!

At Mulai Console, we believe in #InclusiveRegtech and #OpenSourceAML—making financial crime-fighting tools accessible to all! 🛡️

📖 Learn more about money laundering terms: [ACAMS Glossary](https://www.acams.org/en/resources/aml-glossary-of-terms)

#FinancialCrime #AntiMoneyLaundering #Smurfing #Structuring #StopFinancialCrime #100HariNulis #RegTech #AML