#QuickBiteCompliance Day 122

🚨 First Line of Defense: The Frontline Guardians Against Financial Crime 🚨

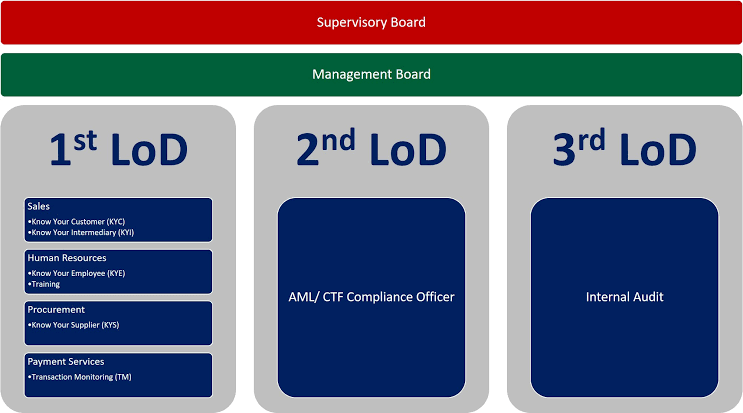

What is the First Line of Defense?

Imagine you’re guarding a castle. The first line of defense is the team at the gate, checking everyone who wants to come in. In the financial world, this team includes employees who onboard new customers, collect their information, and make sure they’re not bad guys in disguise. Their job is to ask the right questions, gather accurate details, and ensure proper screening happens.

How Do Bad Guys Exploit Weaknesses in the First Line?

Even with strong defenses, criminals find ways to sneak in. Here’s how they do it:

1. Fake Identities: Bad guys use fake names, forged documents, or stolen identities to trick the first line of defense. If the frontline team doesn’t verify properly, criminals can slip through.

2. Hiding Ownership: Criminals might hide behind shell companies or complex ownership structures. If the first line doesn’t dig deep enough, they might miss the real bad guys pulling the strings.

3. Rushing the Process: Sometimes, frontline employees are pressured to onboard customers quickly. Bad guys take advantage of this by providing incomplete or misleading information, hoping no one will notice.

Real-Life Example:

Imagine a criminal group wants to open a bank account to launder money. They create a fake company with fake documents and send a smooth-talking representative to the bank. If the frontline employee doesn’t ask enough questions or verify the details, the criminals could successfully open the account and start moving dirty money.

Why Should We Care?

The first line of defense is the first and most critical barrier against financial crime. If they fail, bad guys can enter the system, launder money, fund illegal activities, or even evade sanctions. Strong frontline practices protect everyone—banks, customers, and society.

What Can We Do?

– Empower the First Line: Provide frontline employees with the right tools, training, and support to do their jobs effectively.

– Leverage Technology: Platforms like Mulai Console, with features like Inclusive Regtech and Open Source AML, can help frontline teams verify customer information faster and more accurately.

– Encourage Vigilance: Create a culture where employees feel confident to ask questions, raise red flags, and take their time to get things right.

Let’s keep the conversation going! What are your thoughts on strengthening the first line of defense? Share your ideas below! 👇

📚 Learn more about financial crime terms here: https://www.acams.org/en/resources/aml-glossary-of-terms

#FinancialCrime #AML #FirstLineOfDefense #SanctionsCompliance #InclusiveRegtech #OpenSourceAML #100HariNulis #StayVigilant