#QuickBiteCompliance Day 191

🌍 Offshore: Not Just Beaches and Palm Trees 🌴

Imagine hiding your piggy bank at a friend’s house where your parents can’t find it. Now, picture bad guys doing the same thing—but with millions of dollars. That’s how “offshore” works in the world of money crimes.

When someone says “offshore,” they mean moving money to a faraway country with rules that make it easy to hide. Think of it like a game of hide-and-seek, but with stolen cash! 🕵️♂️💸

How do criminals play this game? Let’s break it down:

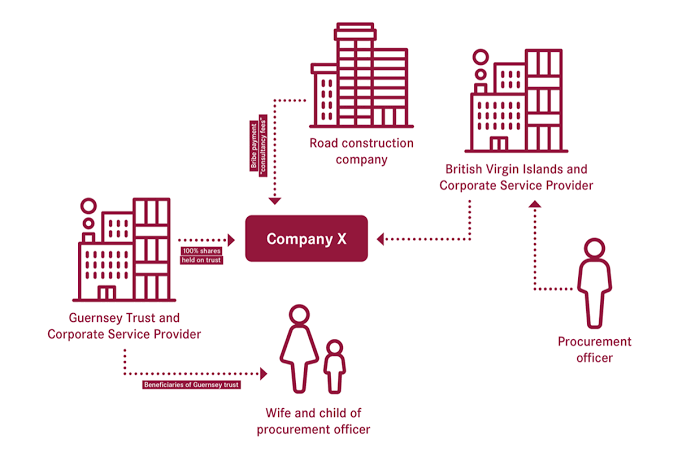

1️⃣ Fake Toy Stores (Shell Companies):

Bad guys create pretend businesses in offshore places—like a toy store that sells nothing. They shuffle money through these “stores” to make dirty cash look clean. 🧸➡️💰

2️⃣ Money Maze (Layering):

They bounce funds between banks in 5+ countries, like a maze. By the time the money stops, no one knows where it started! 🌐🌀

3️⃣ Secret Vaults (Bank Secrecy):

Some offshore banks don’t ask questions. Criminals stash cash there, hidden behind fake names or passwords. 🤫🔒

But here’s the good news: we’re getting better at catching them!

Tools like #InclusiveRegtech (tech that works for everyone) and #OpenSourceAML (free, shared tools to track dirty money) are changing the game. Together, we can turn the maze into a straight line—and keep the bad guys out! 🚀✨

Learn more about financial crime terms: [ACAMS Glossary](https://www.acams.org/en/resources/aml-glossary-of-terms)

#InclusiveRegtech #OpenSourceAML #100HariNulis

(Let’s make finance safer—for everyone!)