Author: Tommy Hartono

-

Day 287: USA PATRIOT Act

#QuickbiteCompliance day 287 The USA PATRIOT Act: 20+ Years Reshaping AML—And How Criminals Still Adapt Signed weeks after 9/11, the USA PATRIOT Act transformed financial crime compliance. While designed to dismantle terrorist financing networks, its legacy is a double-edged sword: powerful new tools for investigators and ingenious workarounds by criminals . Here’s what every finance professional should know: ###…

-

Day 286: Unusual Transaction

#QuickbiteCompliance day 286 💡 Unmasking the Stealth Tactics: How Criminals Exploit Unusual Transactions Financial criminals are masters of disguise, constantly evolving their methods to fly under the radar. One of their most potent weapons? Transactions designed to circumvent reporting thresholds, defy account history, or mismatch expected behavior . These “red flags” are not just anomalies—they are deliberate strategies…

-

Day 285: UN Security Council Resolution 1373 (2001)

#QuickbiteCompliance day 285 🚨 How Terrorist Financiers Turn Global Rules Into Loopholes: The UNSCR 1373 Blind Spots UN Security Council Resolution 1373 (2001) was a landmark move to unify countries against terrorism. It mandated all nations to: – Criminalize terrorist financing – Freeze terrorist assets – Share intelligence across borders But 24 years later, criminals exploit its gaps…

-

Day 284: United Nations

#QuickbiteCompliance day 284 How Criminals Exploit Global Systems & How the UN Fights Back As the world grapples with sophisticated financial crime, the United Nations —founded to uphold peace and collective security—plays a pivotal role in safeguarding global finance. Through initiatives like its Global Programme against Money Laundering (GPML) , the UN empowers nations to combat money laundering and…

-

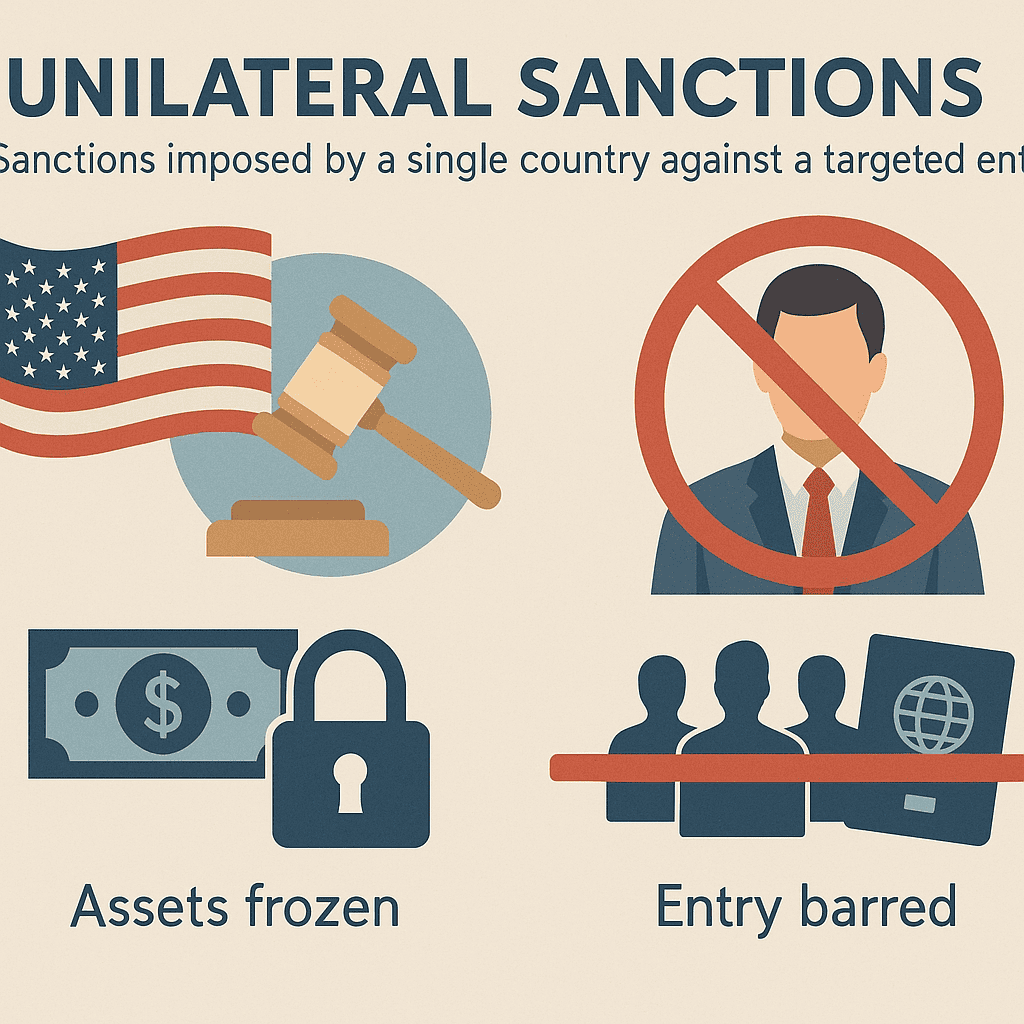

Day 283: Unilateral Sanctions

#QuickbiteCompliance day 283 🚨 Unilateral Sanctions: The Double-Edged Sword in Fighting Financial Crime As financial crime fighters, we know unilateral sanctions—imposed by single nations like the U.S., EU, or Australia—are powerful tools to target human rights abusers, corrupt actors, and rogue regimes. But while they signal moral stance, their unilateral nature creates gaps exploited by…

-

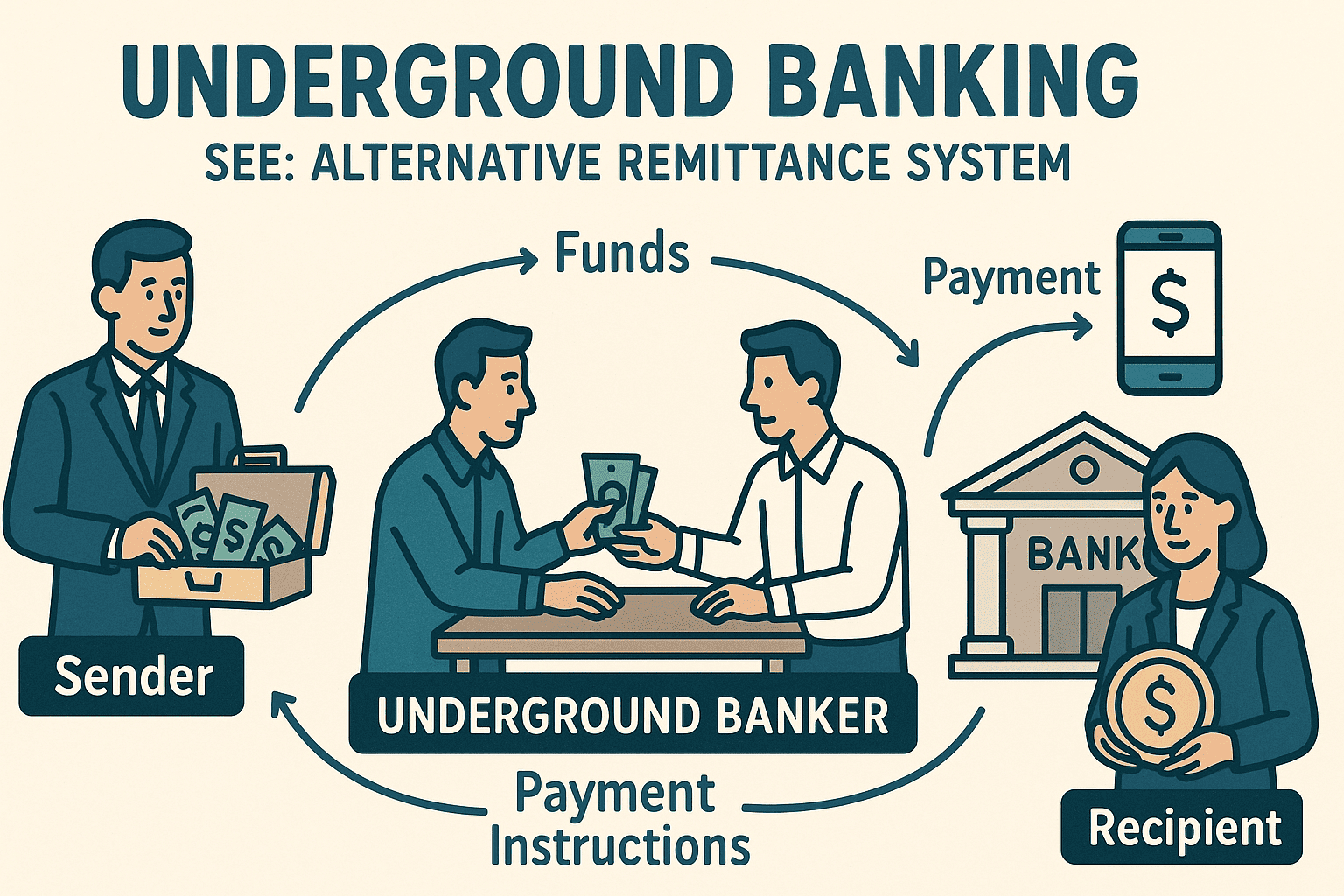

Day 282: Underground Banking

#QuickbiteCompliance day 282 Underground Banking: The Invisible Highway for Financial Crime While traditional banking systems dominate headlines, a parallel financial universe operates in the shadows. Underground Banking—or Alternative Remittance Systems (ARS)—facilitates $500B+ in global transactions annually, often legally serving migrant communities. Yet, its anonymity and lack of oversight make it a magnet for criminals. Here’s…

-

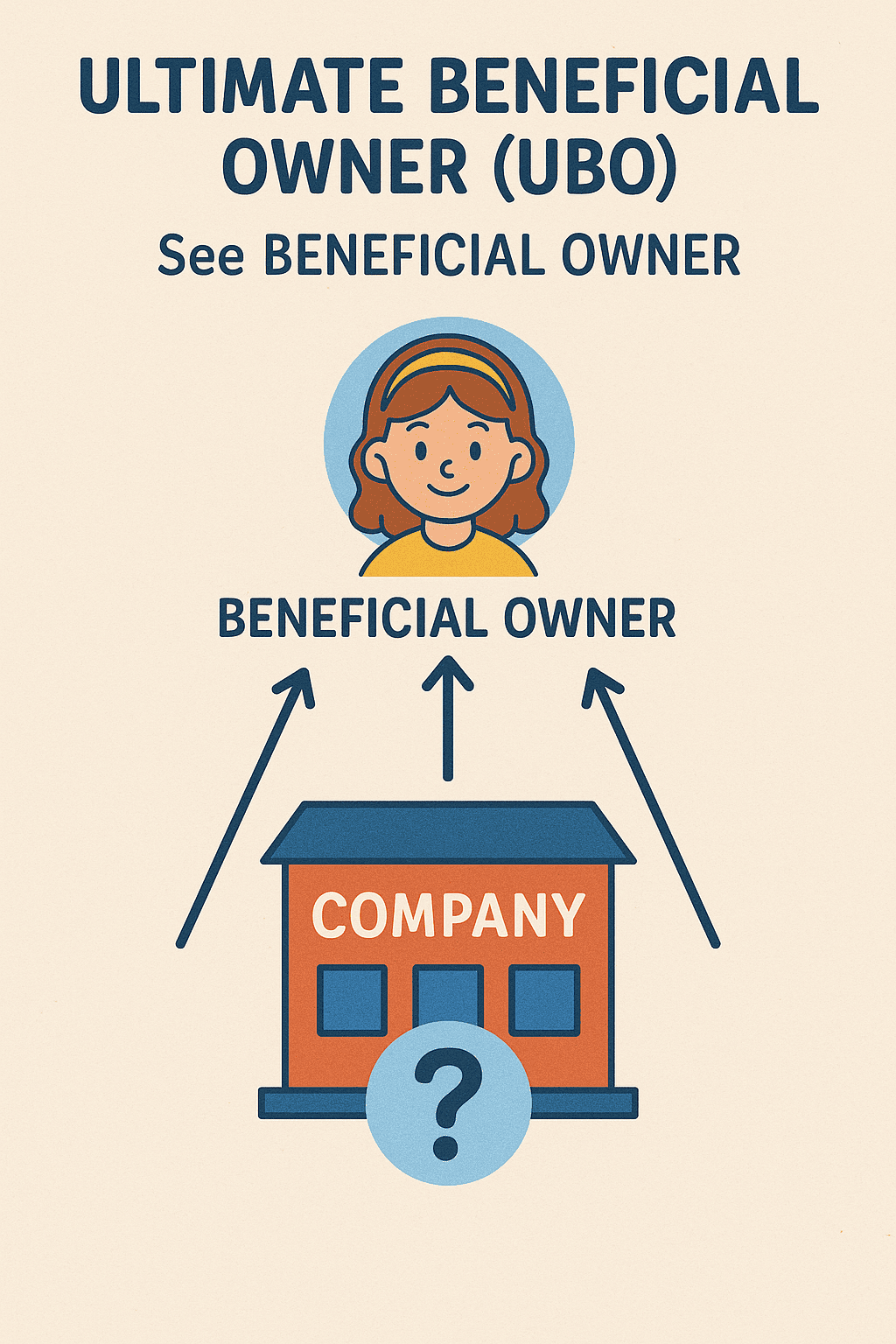

Day 281: UBO

#QuickbiteCompliance day 281 Unmasking the Hidden Puppet Masters: The UBO Story 🔍 Imagine buying a toy from a friend… but the toy actually belongs to their cousin’s neighbor’s dog-walker. Confusing, right? That’s how Ultimate Beneficial Owners (UBOs) work in finance! A UBO is the real human who secretly profits from a business, like a puppet master hiding behind layers of companies.…

-

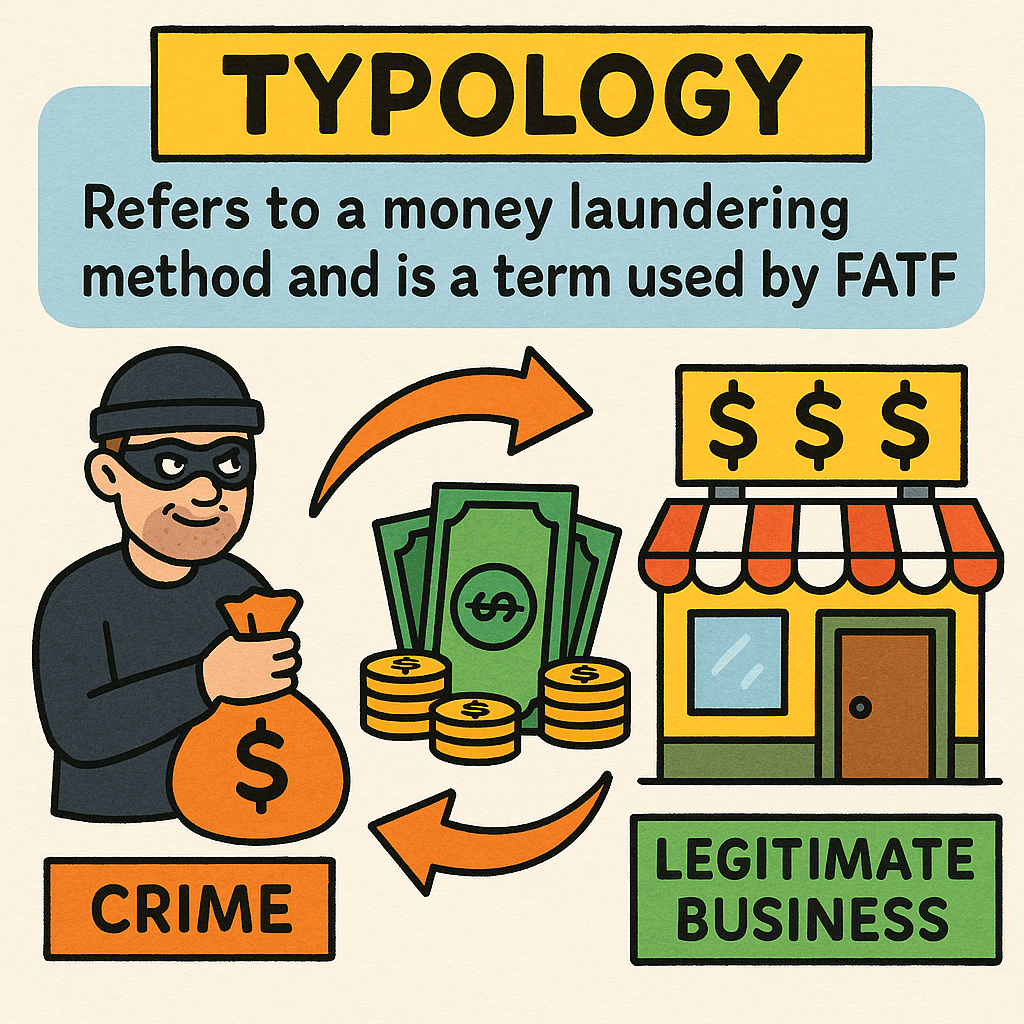

Day 280: Typology

#QuickbiteCompliance day 280 🔍 Catching Bad Guys: What’s a “Typology”? (Hint: It’s Not Dinosaurs!) Imagine a thief steals a cookie 🍪. Instead of eating it whole, they crumble it into tiny pieces, hide crumbs in different jars, swap some for candy 🍬, then rebuild it later. That’s money laundering typology —fancy words for how criminals hide “dirty money” to…

-

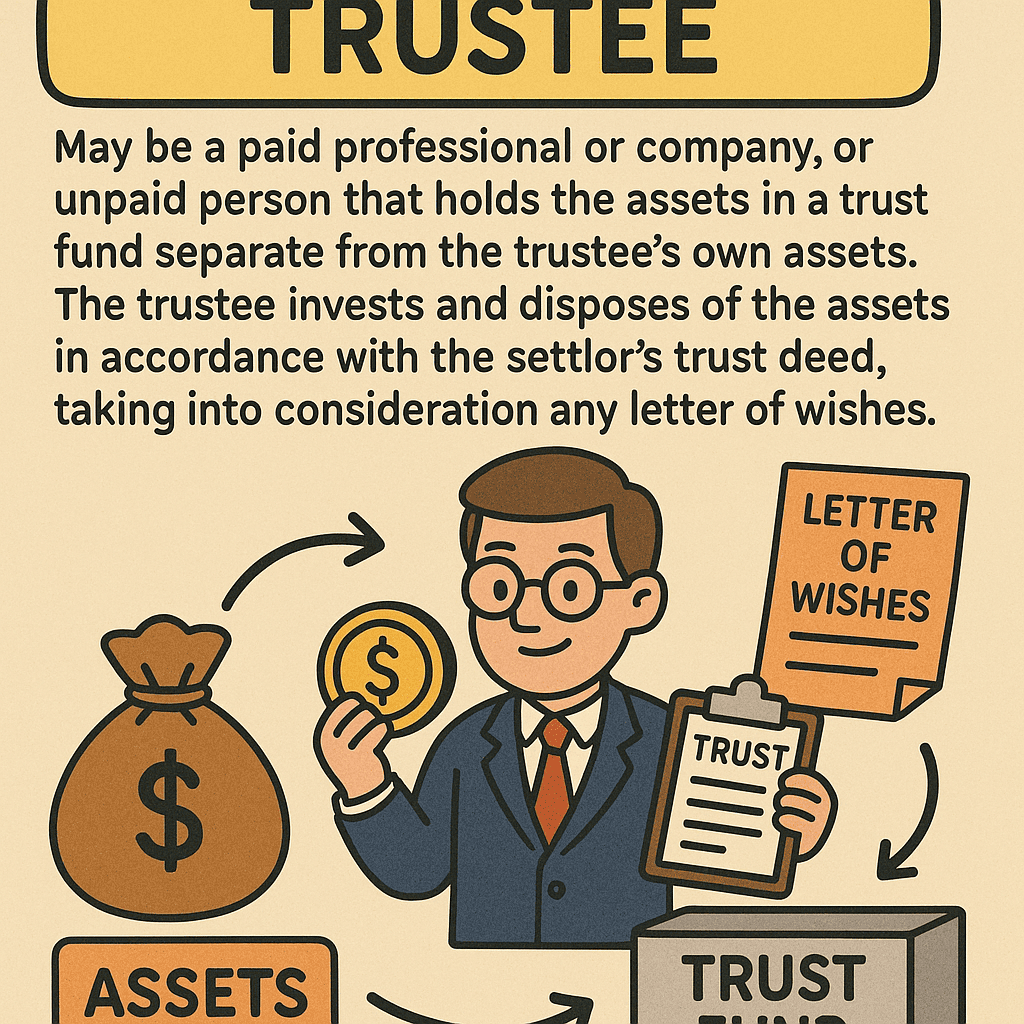

Day 279: Trustee

#QuickbiteCompliance day 279 🚀 Ever Played Hide-and-Seek with Money? Meet the “Trustee”! Imagine your friend lends you their piggy bank to buy toys for them . You promise to keep their money safe and only spend it on their wish list. That’s a trustee ! They hold assets (like cash, houses, or stocks) separately from their own money and follow…

-

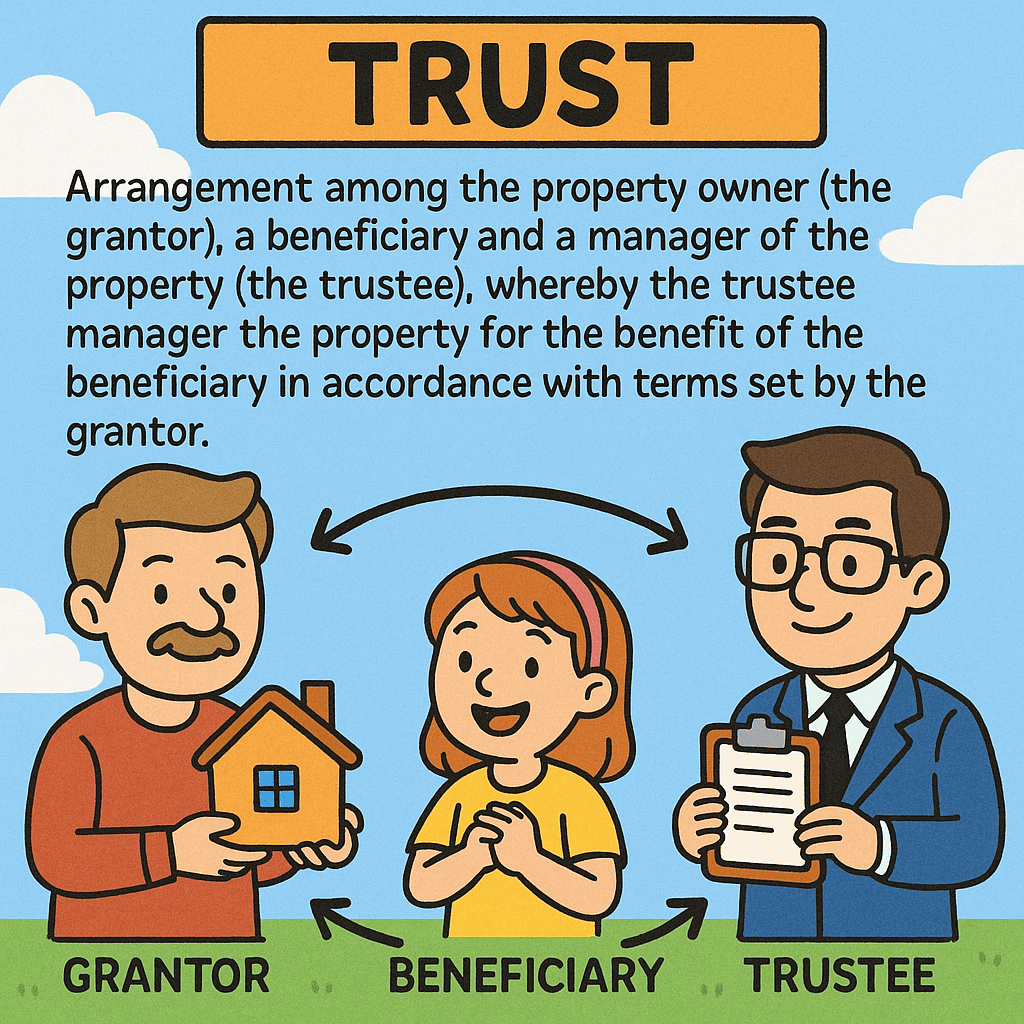

Day 278: Trust

#QuickbiteCompliance day 278 Unlocking the “Secret Treasure Box”: How Bad Guys Hide Money in Trusts (And How We Stop Them) Imagine giving your toy box to a friend to manage. They promise to share toys with other friends only when you say so. That’s a trust in simple terms! 😊 ➡️ Grantor: You (who owns…