by Tommy Hartono | Jul 25, 2025 | Terms

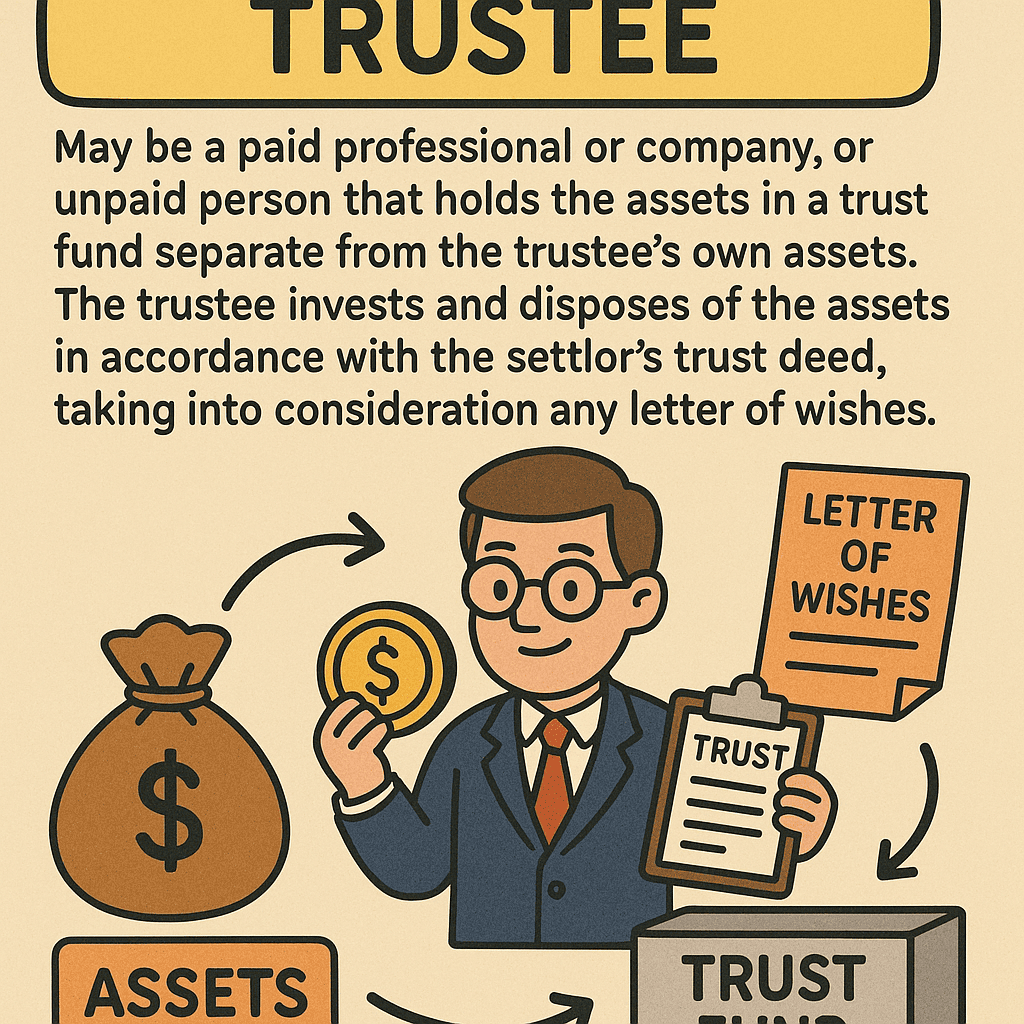

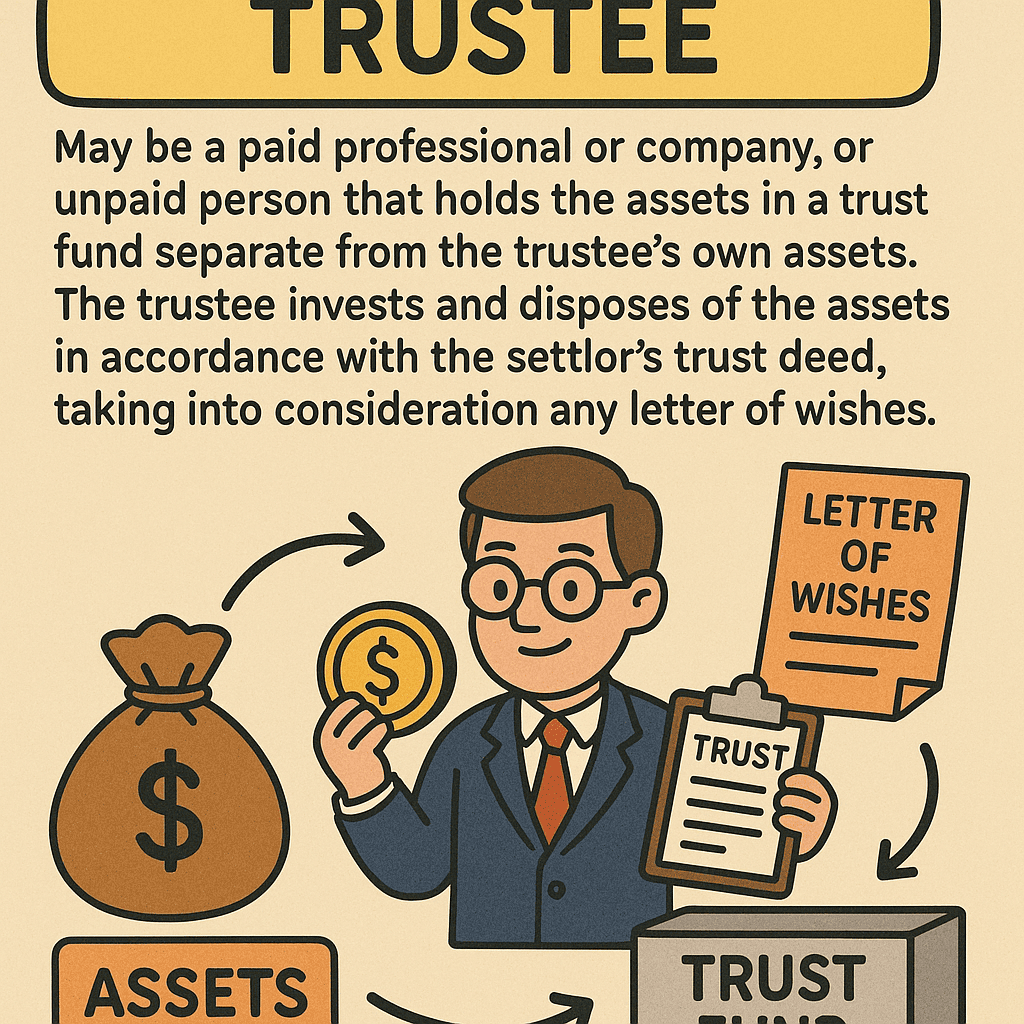

#QuickbiteCompliance day 279 🚀 Ever Played Hide-and-Seek with Money? Meet the “Trustee”! Imagine your friend lends you their piggy bank to buy toys for them . You promise to keep their money safe and only spend it on their wish list. That’s...

by Tommy Hartono | Jul 24, 2025 | Terms

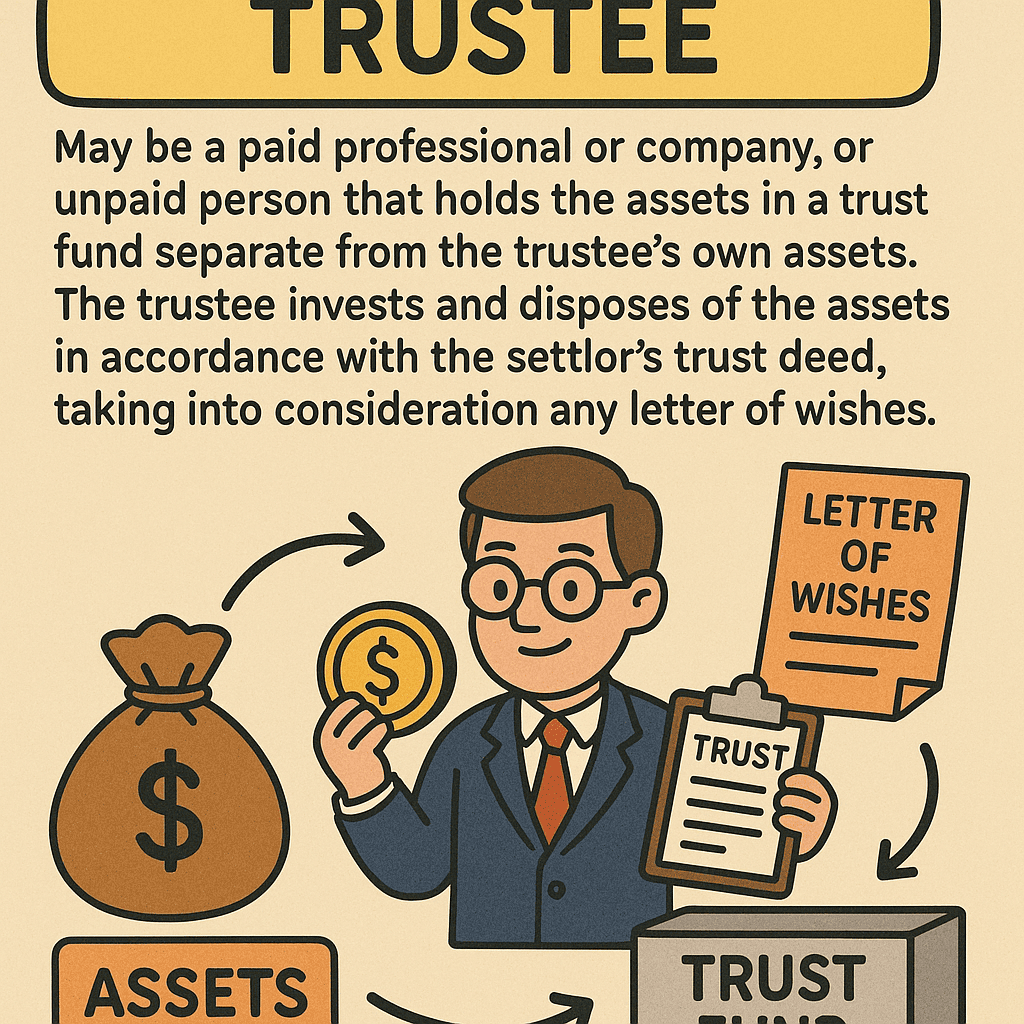

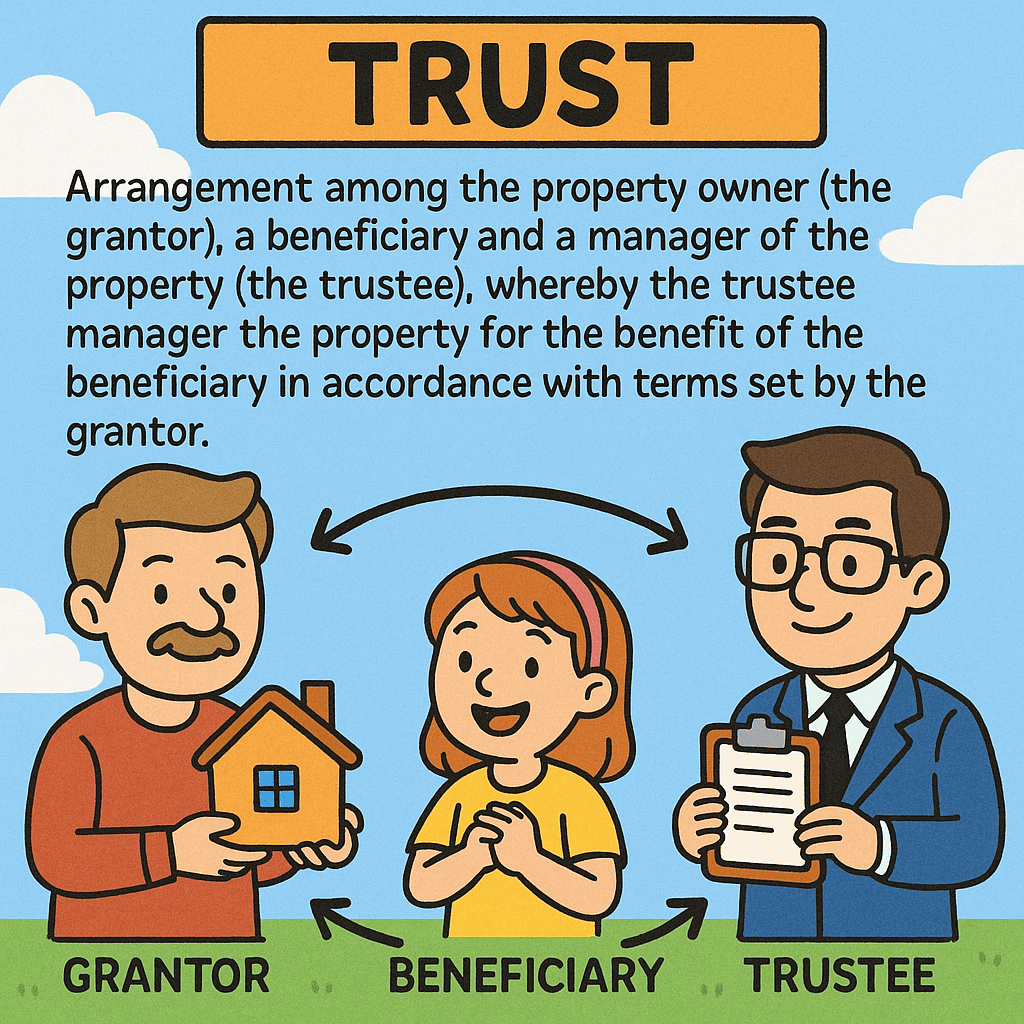

#QuickbiteCompliance day 278 Unlocking the “Secret Treasure Box”: How Bad Guys Hide Money in Trusts (And How We Stop Them) Imagine giving your toy box to a friend to manage. They promise to share toys with other friends only when you say so....

by Tommy Hartono | Jul 23, 2025 | Terms

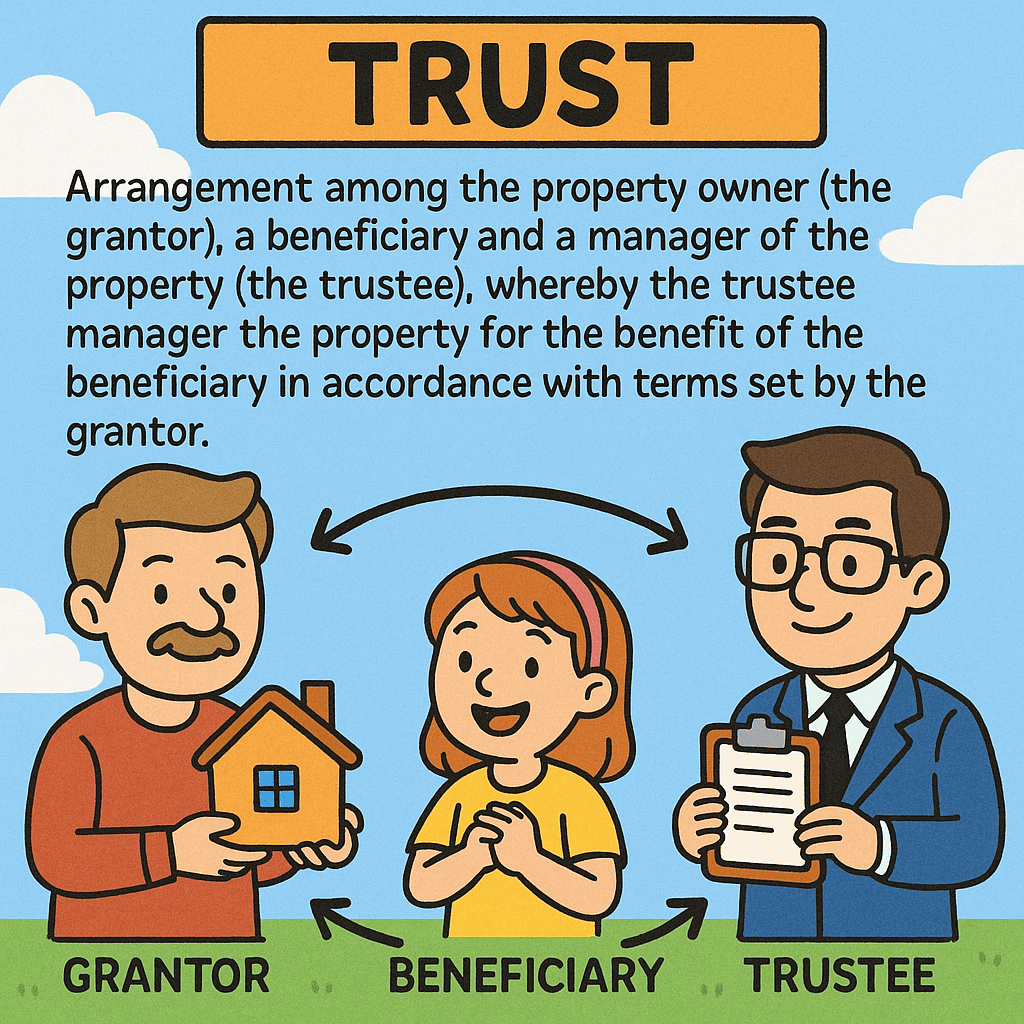

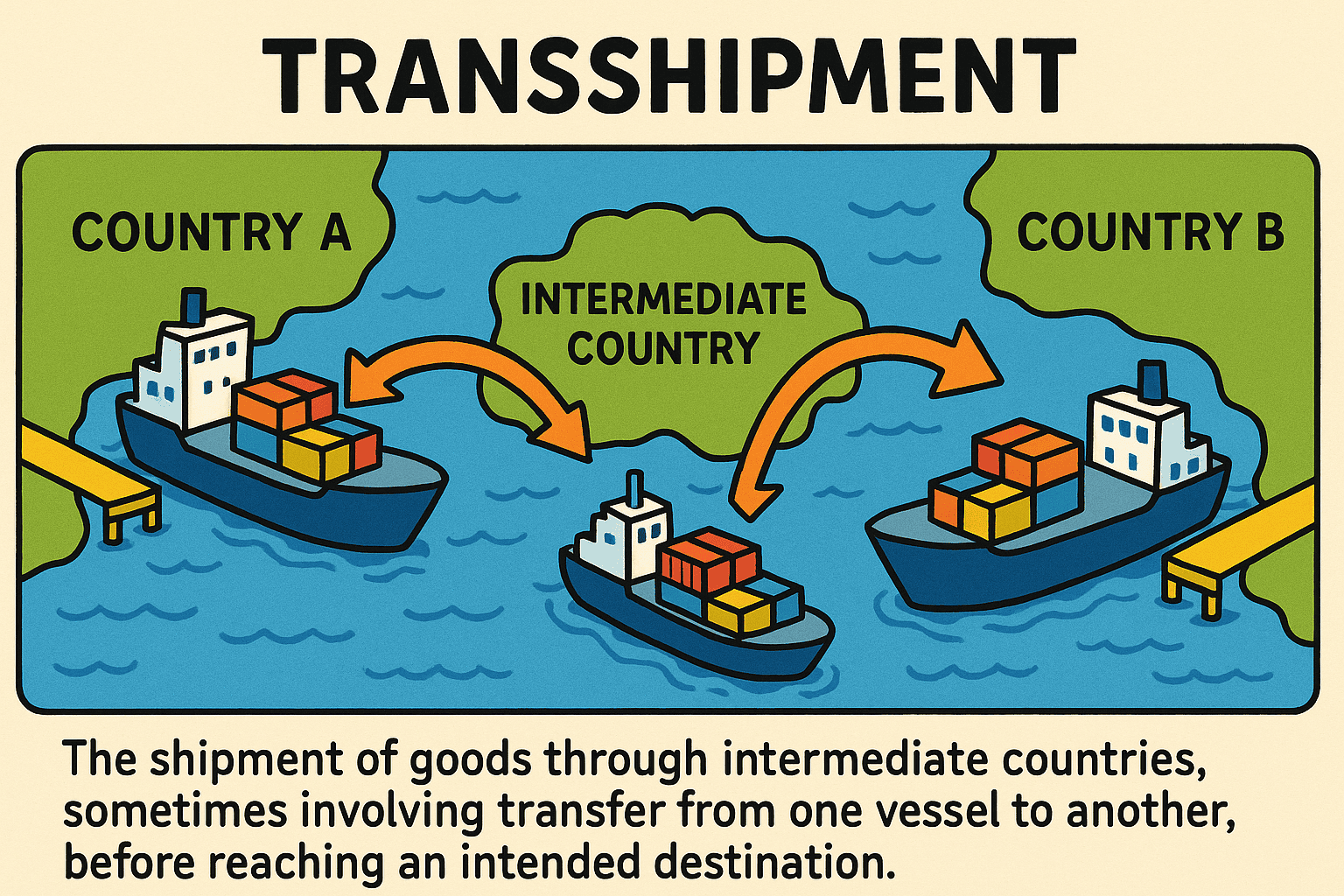

#QuickbiteCompliance day 277 🚢 The Magic Trick Hiding Dirty Money: Transshipment! Imagine a magician making a toy disappear from one box… only for it to secretly appear in another box far away. That’s how transshipment works—goods move through hidden stops...

by Tommy Hartono | Jul 22, 2025 | Terms

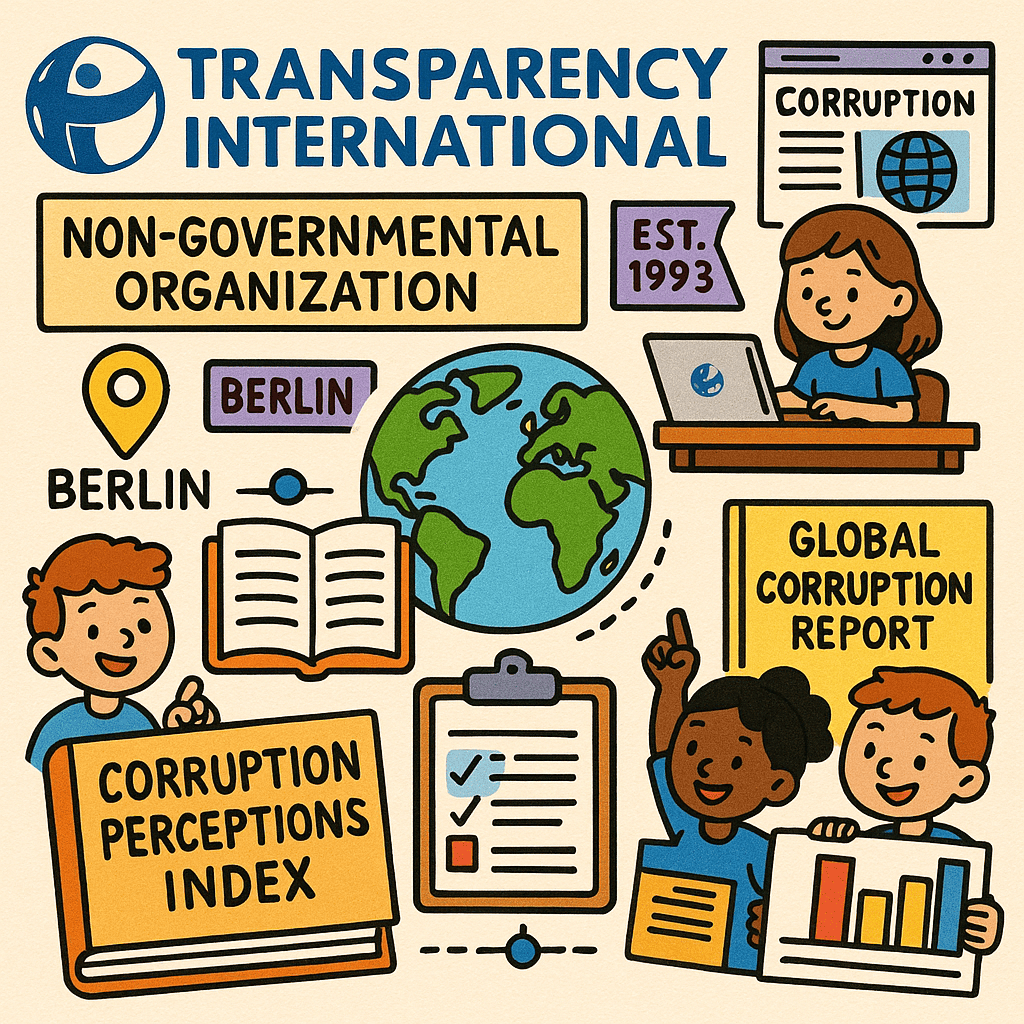

#QuickbiteCompliance day 276 🚨 Corruption Isn’t Just Coins in a Piggy Bank—It’s a Global Crime Engine! Did you know? Bad actors turn dirty money into “clean” cash by hiding it behind fake companies, luxury homes 🏠, or even foreign passports. For example: ...

by Tommy Hartono | Jul 21, 2025 | Terms

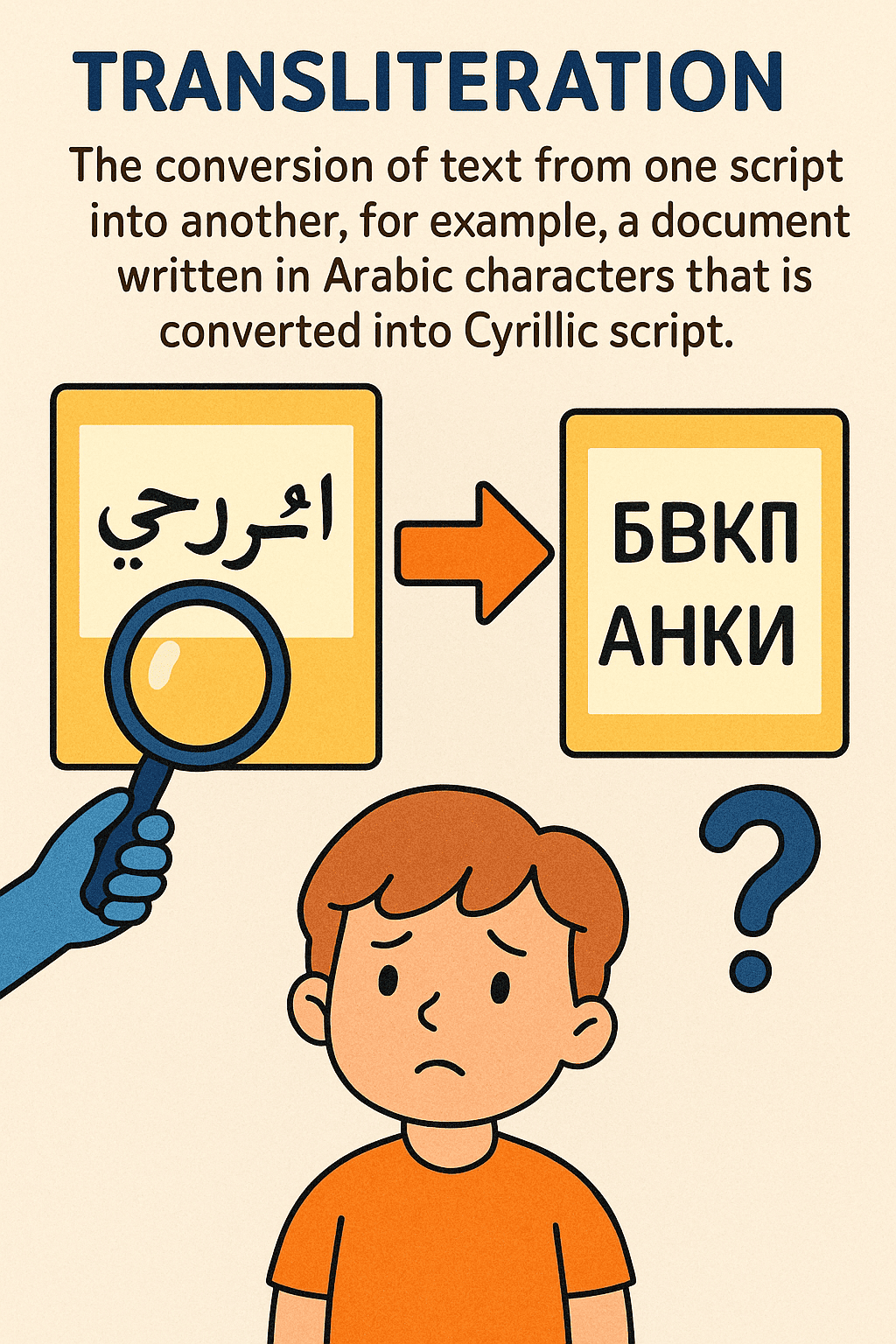

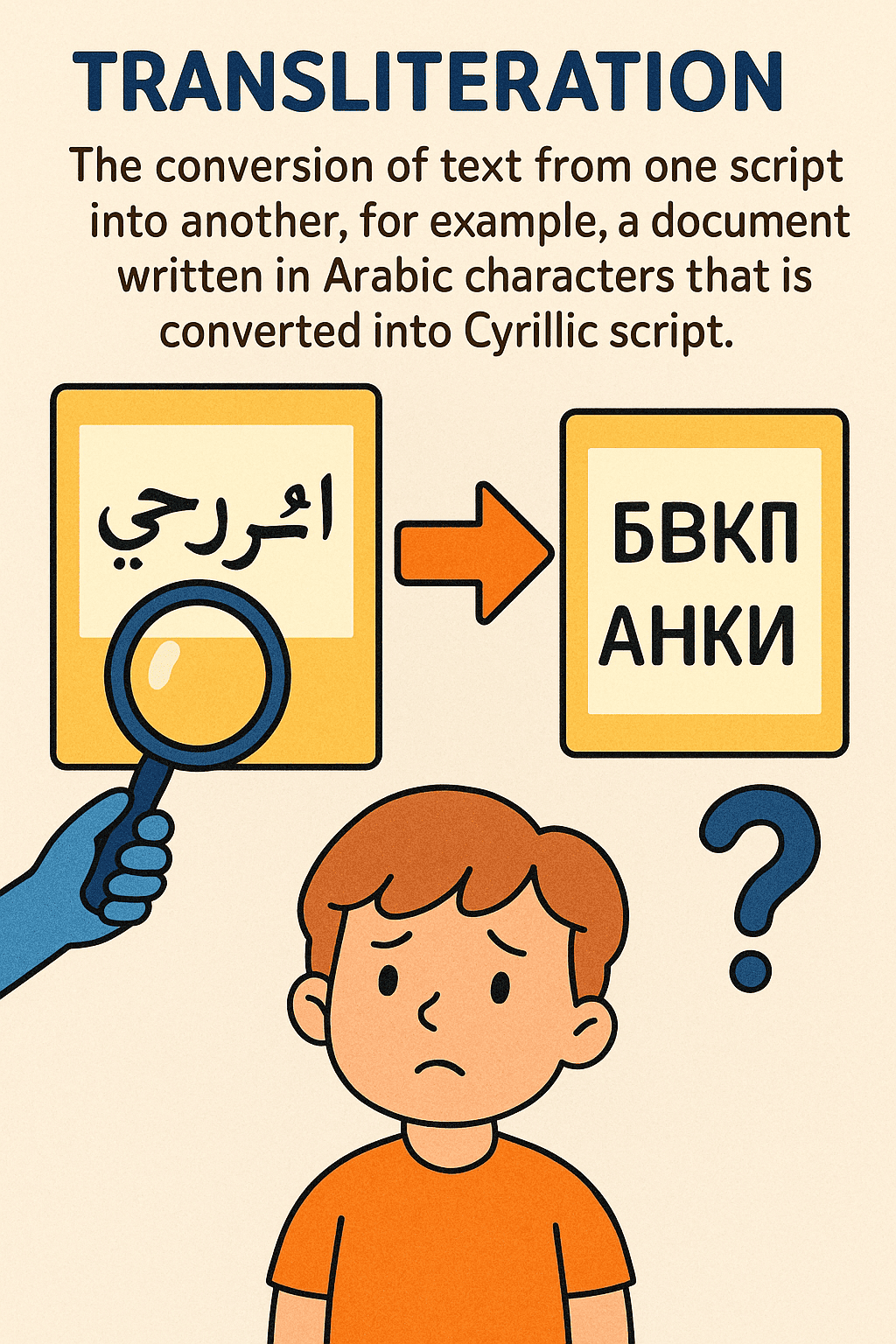

#QuickbiteCompliance day 275 🚨 Hidden in Plain Sight: The “Alphabet Trick” Fueling Financial Crime! Imagine your name changing spelling every time you cross a border. “Mohammed” becomes “Muhamad,” “Muhammad,” or “Mehmet” 🌍➡️🇷🇺➡️🇨🇳. This isn’t...