Category: Terms

-

Day 225: Sanctions

#QuickbiteCompliance day 225 🚨 How Sanctions Stop Bad Guys (And How They Try to Cheat) 🚨 Did you know countries sometimes use “sanctions” like a timeout for rule-breakers? 🛑 Sanctions block trade, money, or travel to pressure bad actors—like criminals, terrorists, or corrupt leaders—to stop harmful behavior. But guess what? Bad guys cheat. Here’s how: …

-

Day 224: Safe Harbor

#QuickbiteCompliance day 224 Safe Harbor: Protection for Good Faith Reporting—But Can Criminals Abuse It? Safe harbor laws protect banks and employees when they report suspicious activity—even if no crime is ultimately found. This encourages more reporting without fear of lawsuits. But here’s the catch: Bad actors can exploit safe harbor by flooding systems with false…

-

Day 223: Romanization

#QuickbiteCompliance day 223 Romanization: A Hidden Challenge in Fighting Financial Crime Did you know that the way names are spelled can help criminals hide their tracks? Romanization is the process of converting names or words from non-Latin scripts (like Arabic, Cyrillic, or Chinese) into the A-Z alphabet. But since some languages don’t have exact matches,…

-

Day 222: Risk based Approach

#QuickbiteCompliance day 222 🚀 Why a “One-Size-Fits-All” Approach Fails in Fighting Financial Crime 🚀 Imagine if a doctor gave the same medicine to every patient—whether they had a cold, a broken bone, or a heart problem. That wouldn’t work, right? The same goes for fighting financial crime! A Risk-Based Approach (RBA) means assessing the different…

-

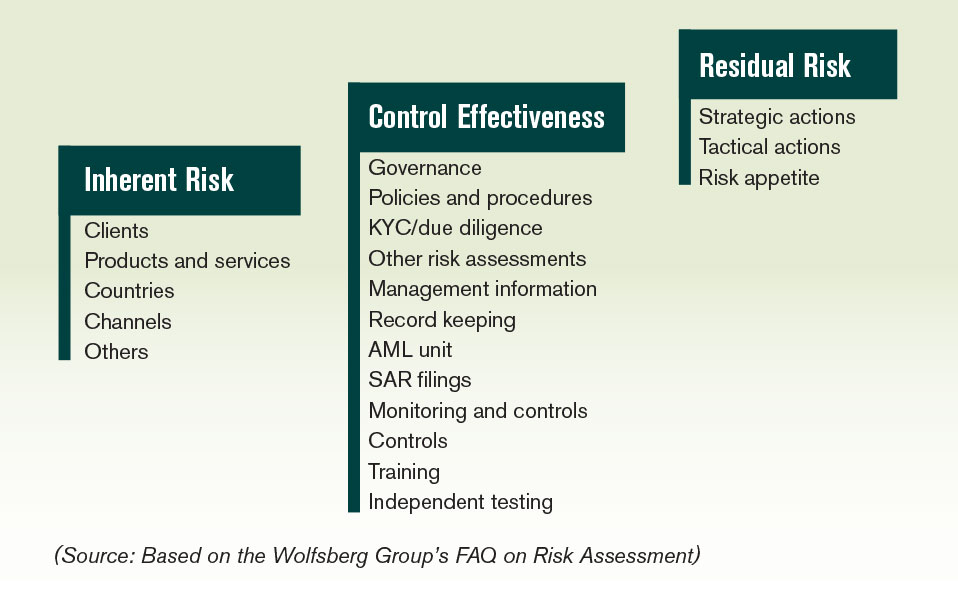

Day 221: Risk Assessment

#QuickbiteCompliance day 221 🔍 Risk Assessments: Your Business’s Superpower Against Financial Crime! Think of a risk assessment like a superhero’s X-ray vision—it helps businesses spot hidden dangers before they become big problems. For banks and companies, it’s the secret weapon to stay safe from sanctions violations, money laundering, and fraud. ### 🕵️ How Do Criminals…

-

Day 220: Risk Appetite

#QuickbiteCompliance day 220 🚀 Understanding Risk Appetite: How Much Risk Should a Company Take? Imagine you’re playing a game where you can win big, but you might also lose. How much are you willing to risk? Companies face the same question every day—this is called Risk Appetite. It’s the level of risk a business is…

-

Day 219: Restrictive Measures

#QuickbiteCompliance day 219 🚫 Stop Bad Guys from Bypassing Sanctions! 🚫 Did you know that bad guys try to sneak around rules called sanctions? Sanctions are like a “STOP” sign from governments to block criminals, terrorists, and corrupt leaders from moving money. But these sneaky criminals find ways to cheat! ### How Do They Do…

-

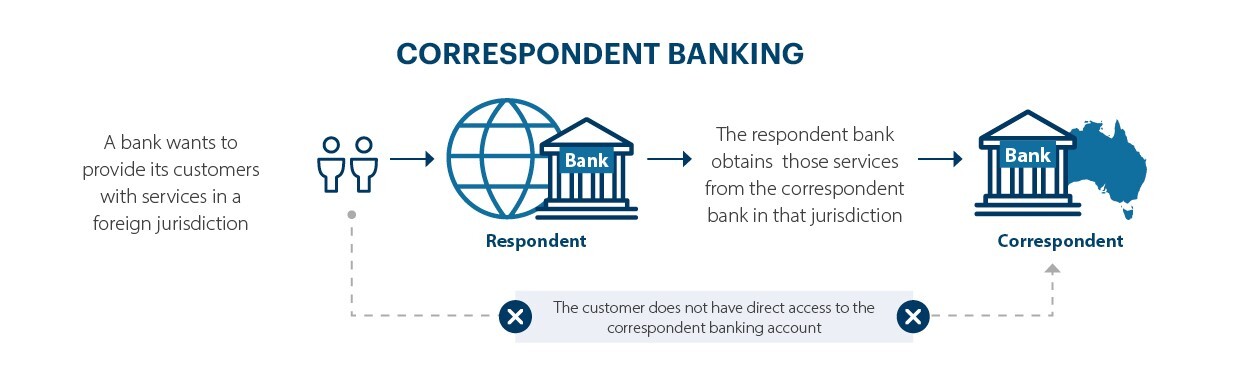

Day 218: Respondent Bank

#QuickbiteCompliance day 218 🚨 How Criminals Exploit “Respondent Banks” to Move Dirty Money 🚨 Did you know that some banks act as a “middleman” for other banks? These are called respondent banks—banks that rely on bigger “correspondent banks” to handle transactions for them, especially in different countries. While this system helps move money globally, criminals…

-

Day 217: Reputation Risk

#QuickbiteCompliance day 217 Why Reputation is a Bank’s Superpower (and How Criminals Try to Steal It) Think of a bank’s reputation like a superhero’s cape—if it gets torn, people stop believing they can save the day. Reputational risk is when bad news (true or not) makes customers lose trust in a bank. And once trust…

-

Day 216: Reporting Requirements, Initial and Periodic

#QuickbiteCompliance day 216 🚨 Why Financial Reporting Requirements Matter in Fighting Crime 🚨 Did you know banks and financial institutions have to file special reports when they spot suspicious or blocked transactions? 📝 These “initial” and “periodic” reports help authorities track dirty money—but criminals still find ways to cheat the system. ### How Bad Actors…