Category: Terms

-

Day 215: Remittance Services

#QuickbiteCompliance day 215 🚨 How Remittance Services Can Be Misused for Financial Crime 🚨 Did you know that remittance services (also called giro houses or casas de cambio) help people send money abroad but can also be exploited by criminals? 💸 Here’s how bad guys misuse them: 🔹 Structuring (Smurfing) – Criminals split large amounts…

-

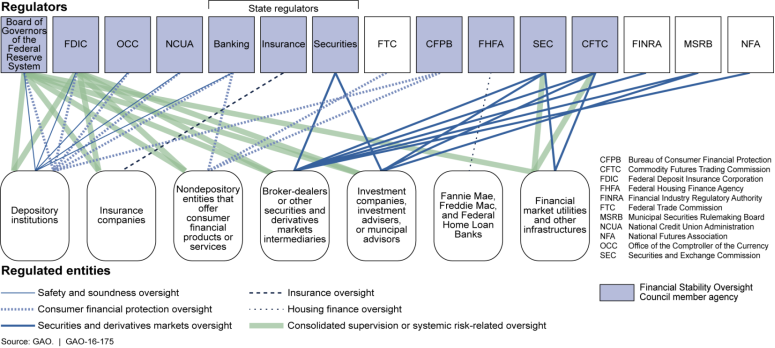

Day 214: Regulatory Agency

#QuickbiteCompliance day 214 🏛️ Regulatory Agencies: The Financial Crime Police – But Can Criminals Trick Them? Think of regulatory agencies as the “financial police” – they make rules, check banks, and stop money laundering. But just like thieves study security systems, criminals find ways to exploit gaps in regulation. ### 🚨 How Do Bad Actors…

-

Day 213: Register, Corporate

#QuickbiteCompliance day 213 What’s a Corporate Register? And Why Should We Care in the Fight Against Financial Crime? Imagine you’re looking at a class list at school. It tells you the names of the students, who the teacher is, and when the class started. Simple, right? Now imagine the same thing for a company. That’s…

-

Day 212: Red Flag

#QuickbiteCompliance day 212 🚩 Red Flags in Financial Crime: The Warning Signs You Should Never Ignore Imagine your fire alarm starts beeping—you wouldn’t just remove the batteries and go back to sleep. In financial crime, red flags are like that alarm: they warn us something’s wrong. But criminals count on people ignoring them. ### How…

-

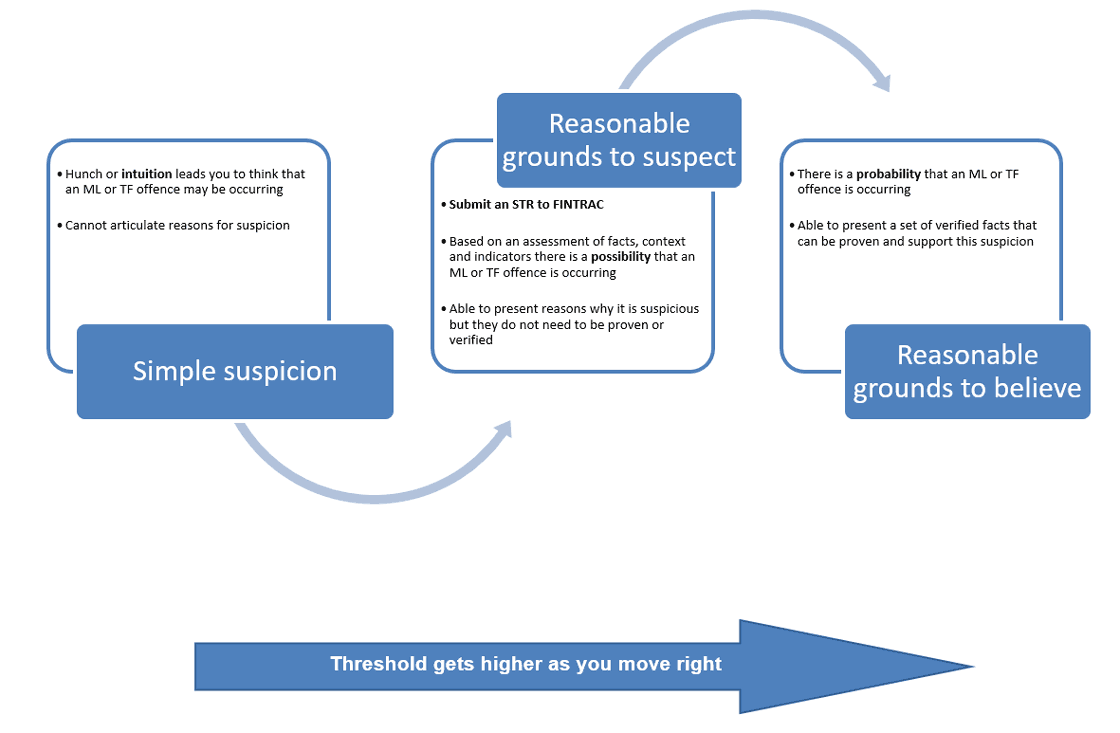

Day 211: Reasonable Cause (To Suspect)

#QuickbiteCompliance day 211 🔍 “Reasonable Cause to Suspect” – The Fine Line Between Vigilance and Oversight in Fighting Financial Crime 🚦 Imagine you’re a teacher, and a student suddenly brings a shiny new phone every day—but you know they don’t have pocket money. You don’t have proof they stole it, but something feels off. That…

-

Day 210: RTGS

#QuickbiteCompliance day 210 🚨 How Criminals Exploit “Instant Money Transfers” (RTGS) – And How to Stop Them 💸🔍 Imagine sending cash to a friend, and it arrives instantly—no waiting, no delays. That’s the power of Real-Time Gross Settlement (RTGS), the system banks use for large, urgent transfers. But while RTGS makes business faster, criminals love…

-

Day 209: Pyramid Scheme

#QuickbiteCompliance day 209 🚨 The “Money Trick” That Robs People – Pyramid Schemes Explained 🎩💸 Imagine your friend tells you: “Give me $10, and if you bring two more friends who also give $10, you’ll get $30!” Sounds easy, right? But what if those friends can’t find new people? The whole thing collapses—and you lose…

-

Day 208: Private Investment Company (PIC)

#QuickbiteCompliance day 208 🚨 How “Secret Money Boxes” Help Bad Guys Hide Dirty Cash �� Imagine you have a secret box where you keep your toys—no one knows what’s inside except you. Now, what if bad guys had a “secret money box” to hide stolen cash? That’s what a Private Investment Company (PIC) can be…

-

Day 207: Private Banking

#QuickbiteCompliance day 207 🚨 How Crooks Hide Dirty Money in “Private Banking” 🚨 Did you know some super-rich people use special bank services called Private Banking? It’s like VIP banking—super private, with fancy investments, secret accounts, and big loans. But guess what? Bad guys LOVE abusing these services to hide stolen money! 💸 ### How…

-

Day 206: Predicate Crimes

#QuickbiteCompliance day 206 🚨 How “Dirty Money” Starts with a Crime (And How to Stop It!) 🚨 Did you know money laundering doesn’t start with fancy bank tricks? It starts with a “predicate crime”—a fancy term for illegal activities that create “dirty money” in the first place! 💸🕵️ ### 🤔 What’s a Predicate Crime? Think…