#QuickBiteCompliance Day 128

Fuzzy Logic: Catching Criminals Who Try to Trick the System

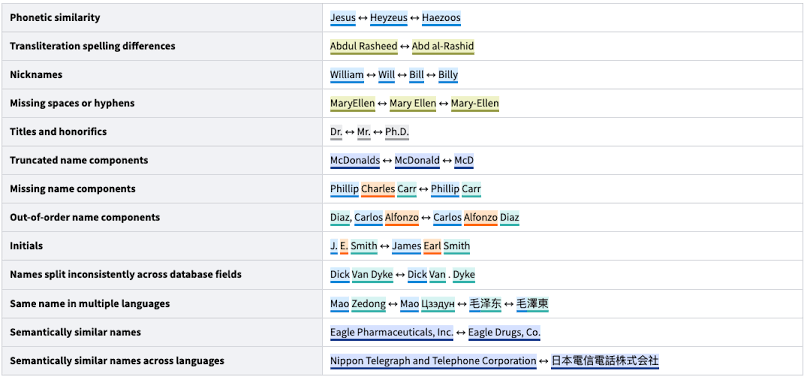

Imagine you’re looking for your friend “John Smith” online, but you accidentally type Jon Smit. Even though it’s misspelled, the search still finds him. That’s because of fuzzy logic—a smart way to recognize things that almost match but aren’t exact.

In financial crime, criminals intentionally change their names slightly to avoid detection. Fuzzy logic helps financial institutions find these sneaky changes and stop bad actors before they can move dirty money.

How Do Criminals Exploit This?

🔹 Misspelling their names – A sanctioned person named Mohammed Ali might register a bank account as Mohamad Aly to bypass screening.

🔹 Changing birth dates – Instead of January 1, 1980, they enter 01/01/80 or 1980-01-02 to trick automated systems.

🔹 Using different alphabets – Some criminals switch between Latin, Cyrillic, or Arabic scripts to disguise their identities.

Why Fuzzy Logic Matters

Fuzzy logic detects these tricks by recognizing names, dates, and words that are similar but not identical. This means banks and regulators can catch criminals faster—even when they try to hide behind small changes.

The Challenge: False Positives

Since fuzzy logic finds “close matches,” it sometimes flags innocent people too. That’s why advanced Regtech (Regulatory Technology) and Open Source AML tools—like those on Mulai Console—help fine-tune the system, reducing false alarms while still catching the bad guys.

With smarter tech, we stay one step ahead of financial criminals—no matter how they spell their names!

🔗 Source: ACAMS Glossary of AML Terms

#AML #FinancialCrime #Regtech #InclusiveRegtech #OpenSourceAML #100HariNulis