#QuickBiteCompliance Day 161

The Hidden Risks of Letters of Credit: How Criminals Exploit This Financial Tool

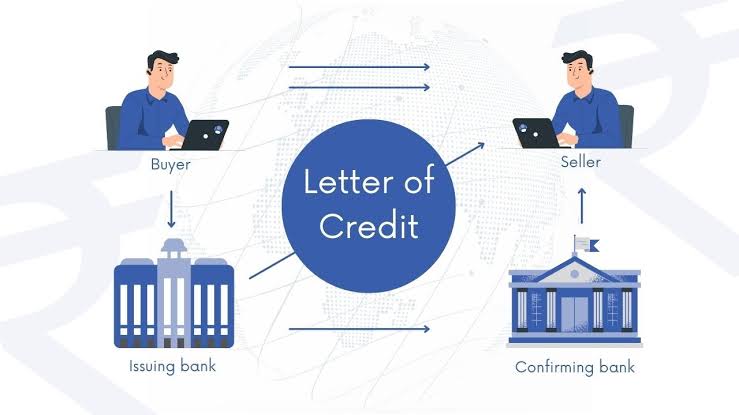

Imagine you own a toy store and want to buy 1,000 teddy bears from a factory overseas. You don’t know the factory owner personally, so you ask your bank to issue a Letter of Credit (LC). This is like a promise: if the factory ships the teddy bears as agreed, your bank will pay them. The factory feels safe, so they send the toys. A win-win, right?

But what if criminals use this system to move dirty money?

Here’s how bad actors misuse LCs for financial crime:

🔴 Overstated Invoices: A corrupt business owner gets an LC for $1M worth of goods but only ships $100K worth. The extra $900K is pocketed and disguised as a legal transaction.

🔴 Fake Shipments: No actual goods are sent—just fake documents making it look like a shipment happened. The bank pays out, and the money disappears into offshore accounts.

🔴 Round-Tripping: A company ships goods to itself through a different country, inflating prices each time. This creates the illusion of real trade while laundering illicit funds.

🔴 Terrorist Financing: Bad actors use LCs to secretly fund criminal organizations under the cover of normal trade.

💡 How Do We Fight Back?

With Inclusive Regtech solutions like Mulai Console, regulators and banks can leverage Open Source AML tools to detect suspicious LC patterns. By using technology to analyze trade finance data, we can spot red flags before the money disappears.

Financial crime is evolving. Our defenses must evolve too. Let’s build a more transparent financial system together!

🔗 Source: ACAMS AML Glossary

#FinancialCrime #TradeBasedMoneyLaundering #AML #Regtech #InclusiveRegtech #OpenSourceAML #100HariNulis