#QuickBiteCompliance Day 179

🚨 Ever heard of a country’s “financial report card”? Let’s talk about Mutual Evaluation Reports (MERs)!

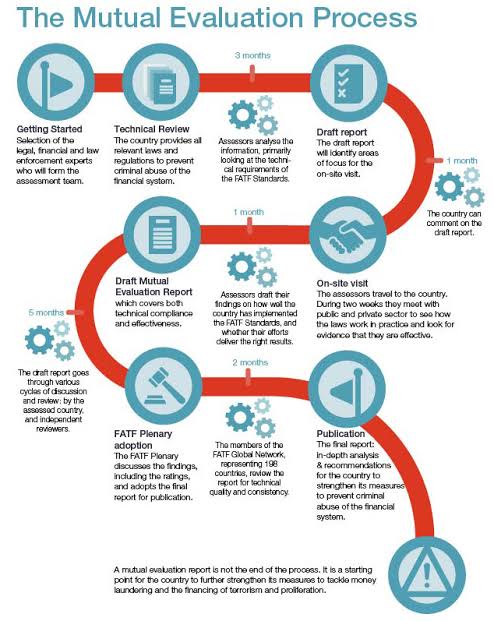

Imagine if every country got a “grade” on how well it stops bad guys from moving dirty money, funding terrorists, or hiding shady transactions. That’s basically what an MER is! These reports (by groups like the FATF) don’t punish countries, but they do tell banks and businesses, “Hey, be careful here—this place might have weak rules.”

🕵️♂️ How do criminals abuse weak MER grades? Let’s pretend:

1. “Fake Charity, Real Crime”

If a country’s MER says nonprofits aren’t checked properly, crooks might start a “charity” to funnel stolen money. 💸 “Donations” go in, cash for weapons comes out.

2. “The Mystery Shopping Cart”

A country with bad trade oversight? Criminals buy $10 pencils but invoice them as $1,000 gold bars. 📦 Suddenly, illegal cash looks like legit business profits.

3. “Bank? More Like Blank Check!”

If banks in Country X don’t verify who opens accounts (thanks to a bad MER), gangsters set up fake companies there to launder drug money globally. 🏦🌍

🛠️ How do we fight back?

Tools like InclusiveRegtech (tech that makes rules simpler for everyone) and OpenSourceAML (free tools to track dirty money) help countries “level up” their MER grades. Think of it like giving teachers better tools to grade fairly—and stop cheaters!

📚 Want to learn more? Check out terms like “MER” in the [ACAMS Glossary](https://www.acams.org/en/resources/aml-glossary-of-terms)—it’s like a dictionary for fighting financial crime!

💡 The takeaway: MERs aren’t just paperwork. They’re a map showing where criminals might strike next. By sharing smarter tech and ideas (OpenSourceAML), we can protect the global economy—one “grade improvement” at a time.

FinancialCrimePrevention RiskManagement InclusiveRegtech OpenSourceAML 100HariNulis

P.S. 👋 Tag someone who’d geek out over financial report cards! Let’s make AML everyone’s business.