#QuickBiteCompliance Day 183

🔍 Nested Accounts: The Hidden Maze Where Criminals Hide Their Tracks!

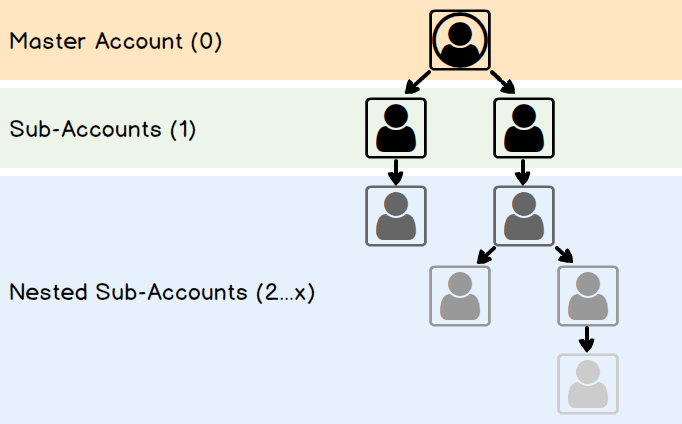

Imagine a big bank (let’s call it “Bank A”) that acts like a main door for smaller banks to send money globally. Now, what if those smaller banks let even more banks use their access to Bank A? Suddenly, Bank A is moving money for institutions it’s never directly met. This “chain of access” is called a nested account—and while it helps businesses, criminals love to abuse it.

🕵️♀️ How Do Bad Guys Exploit Nested Accounts?

– Layers of Lies: Criminals use chains of banks (Bank B → Bank C → Bank D) to hide where money really came from. It’s like playing a game of telephone, but with dirty cash!

– Fake Friends: A shady company in Country X tricks a small bank into giving them access. They then send stolen funds through 5 nested banks, making it nearly impossible to trace.

– Ghost Transactions: Terror groups use nested accounts to move money through “friendly” banks that don’t ask questions, disguising payments as charity or trade.

🌐 Real-World Example:

A corrupt official steals $1 million. Instead of moving it directly, they send it through Bank B (which uses Bank A’s network). Bank A only sees Bank B’s name, not the official’s. By the time the money reaches an offshore account, the trail is buried under layers of “legitimate” banks.

💡 Cutting Through the Noise with #InclusiveRegtech & #OpenSourceAML!

Nested accounts aren’t evil—they’re just tools. The problem? Many compliance systems can’t “see” past the first layer. That’s where smarter tech comes in!

– Inclusive Regtech understands complex banking chains, no matter how many layers.

– Open Source AML lets banks share data (safely!) to spot hidden patterns, like a $10 million “charity donation” bouncing through 3 nested banks in 24 hours.

🚀 Together, We Can Unlock the Maze

Financial crime thrives in shadows. By embracing tools that map nested networks and prioritize transparency, we turn criminals’ “smart tricks” into useless dead ends.

📚 Dive deeper into AML terms: [ACAMS Glossary](https://www.acams.org/en/resources/aml-glossary-of-terms)

💬 What other financial “mazes” should we tackle next?

#InclusiveRegtech #OpenSourceAML #100HariNulis #FollowTheMoney #StopFinancialCrime