#QuickBiteCompliance Day 199

🚨 Don’t Play Hot Potato with Sanctions Risk! 🚨

Picture this: You’re playing a game of hot potato, but instead of a potato, it’s sanctions risk—and everyone keeps passing it down the line. “Not my problem!” they say. But here’s the catch: bad guys win when no one takes responsibility.

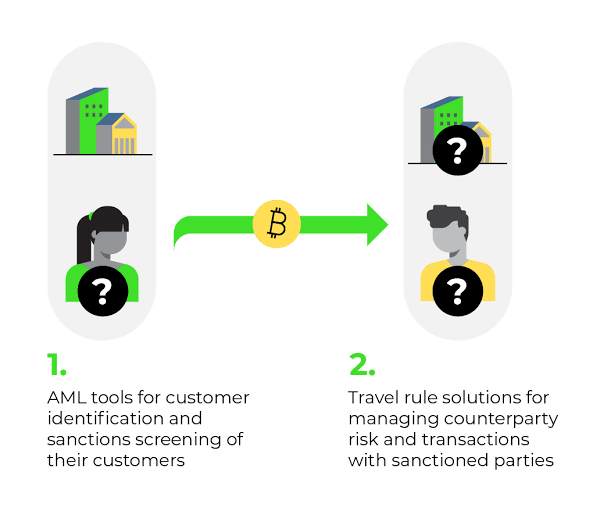

Pass-through sanctions risk happens when companies assume their customer’s affiliates or subsidiaries are “someone else’s job” to check. Regulators in the UK, US, and beyond disagree. They say: Everyone in the transaction chain must check for risks—like hidden links to sanctioned entities.

### How Criminals Sneak Through 🕵️♂️

Bad actors love this game. They hide behind layers of companies, knowing some won’t look too closely. For example:

– A sanctioned oil company uses a subsidiary named “PetroGlobal LLC” instead of “PetroGlobal Inc.” to trick banks.

– A criminal’s cousin opens a “clean” front company to move dirty money—counting on no one to ask, “Who owns this business?”

If only the “main” customer is checked, the bad guys slip through the cracks. 💸

### The Fix? Stop Passing the Potato! 🛑

Teamwork beats hot potato. Financial institutions must ask: “Who are your affiliates? Who’s in your network?” Then, dig deeper. This is where #InclusiveRegtech (tech that’s fair for all) and #OpenSourceAML (tools everyone can trust) shine—helping flag hidden risks across entire business families.

💡 Fun Fact: Even LEGO sets need all pieces checked. Miss one, and the castle collapses! 🏰

Let’s build a chain of accountability—because crime thrives in the gaps.

📚 Learn more about AML terms: [ACAMS Glossary](https://www.acams.org/en/resources/aml-glossary-of-terms)

✨ #InclusiveRegtech #OpenSourceAML #100HariNulis #StopSanctionsSlipups

P.S. Ever spotted a “hidden link” in a transaction chain? Share your story below! 👇

—

Like this? Follow for more simple breakdowns on outsmarting financial crime. No jargon, just action! 🌍🔍