#QuickBiteCompliance Day 200

🚨 Ever Heard of a “Secret Tunnel” for Money? Let’s Talk Payable Through Accounts (PTAs)! 🚨

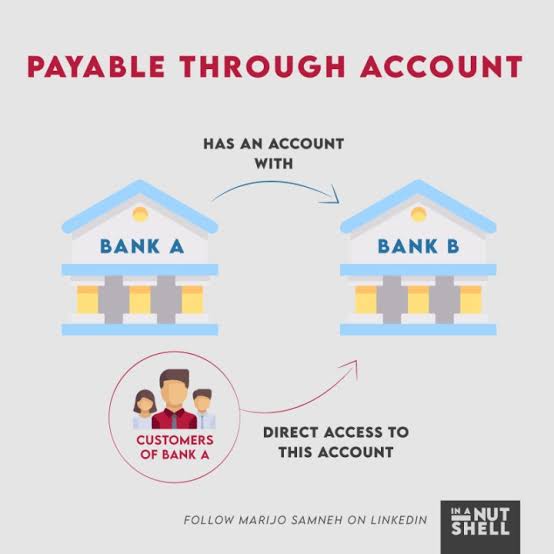

Imagine you’re sharing a mailbox with strangers. They can send and receive letters, but you don’t know who they are or what’s inside. That’s kind of how Payable Through Accounts (PTAs) work. Banks open these accounts for foreign institutions, but their customers get to use the account directly. The problem? Banks can’t always see who’s really moving the money. 😱

Here’s how bad guys exploit PTAs:

1️⃣ Hide & Seek with Dirty Money: Criminals use PTAs to shuffle illegal cash across borders. For example, a fake toy company in Country A sends “sales” to a PTA, but it’s actually drug money from Country B. The bank sees the foreign institution’s name, not the shady toy seller.

2️⃣ Sanctions? What Sanctions?: A banned entity in Country X uses a PTA through a “friendly” foreign bank to pay for goods, bypassing sanctions. The transaction looks clean because the PTA hides the real user.

3️⃣ Ghost Businesses: Scammers create fake companies abroad, link them to PTAs, and pretend to sell “exports” to launder money. The bank only sees the foreign institution, not the 10 fake companies behind it.

Why does this matter?

PTAs make it SUPER hard for banks to spot risks. They’re like invisible tunnels for financial crime. But there’s hope! Tools like #InclusiveRegtech and #OpenSourceAML are helping banks shine a light into these shadows. Think smarter tech, teamwork, and transparency! 💡

Let’s keep the conversation going! 👇

How can we balance global banking access with safety?

🔗 Learn more terms like this: [ACAMS Glossary](https://www.acams.org/en/resources/aml-glossary-of-terms)

#FinancialCrimeAwareness #PTARisks #TransparencyMatters #100HariNulis

(P.S. Sharing = Caring! Let’s protect the financial system together.)