#QuickbiteCompliance day 211

🔍 “Reasonable Cause to Suspect” – The Fine Line Between Vigilance and Oversight in Fighting Financial Crime 🚦

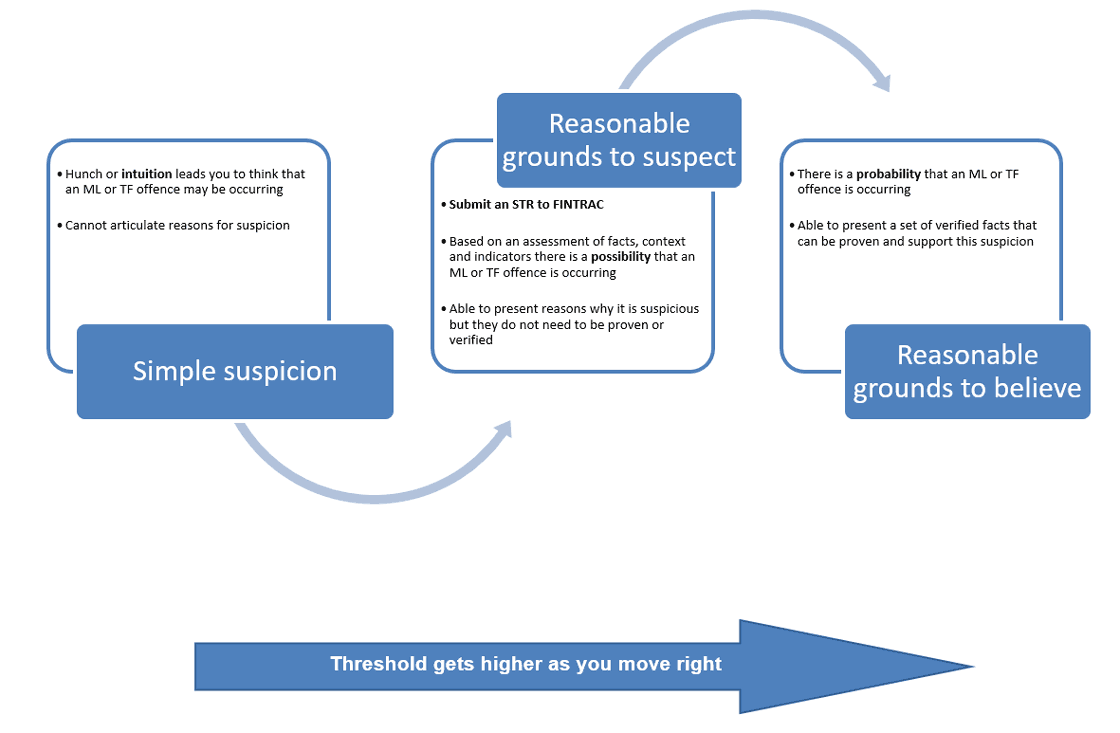

Imagine you’re a teacher, and a student suddenly brings a shiny new phone every day—but you know they don’t have pocket money. You don’t have proof they stole it, but something feels off. That gut feeling? In financial crime compliance, we call it “Reasonable Cause to Suspect.”

### Why This Matters

In the UK (and many jurisdictions), firms must act when they have reasonable cause to suspect:

✔️ Funds tied to sanctioned individuals

✔️ Transactions with no clear lawful purpose

✔️ Customers hiding beneficial ownership

But here’s the catch: Criminals exploit gaps where suspicion isn’t acted upon.

### How Bad Actors Game the System

1️⃣ “Plausible Deniability” Tricks – Structuring transactions just below reporting thresholds to avoid scrutiny.

2️⃣ Abusing Slow Reactions – Moving money quickly through institutions with weaker compliance cultures.

3️⃣ Identity Fog – Using complex corporate structures to make ownership just unclear enough to evade detection.

Real-World Example:

A shell company receives multiple large RTGS payments from high-risk jurisdictions. The bank’s system flags it, but employees dismiss it as a “business anomaly.” Later, it’s linked to a sanctioned entity—could earlier intervention have helped?

### How Do We Strengthen Defenses?

✅ Tech That Connects Dots – AI-driven #InclusiveRegtech can highlight hidden risks in transaction patterns.

✅ Shared Intelligence – #OpenSourceAML helps firms learn from global red flags.

✅ Culture Over Checklists – Training teams to trust and act on their professional judgment.

Thought to Ponder:

“Reasonable cause” isn’t about proof—it’s about preventing harm. In finance, hesitation can mean enabling crime.

📖 Dive deeper: [ACAMS Glossary – Reasonable Cause](https://www.acams.org/en/resources/aml-glossary-of-terms)

#FinancialCrime #AML #Compliance #Sanctions #100HariNulis #RiskManagement