#QuickbiteCompliance day 218

🚨 How Criminals Exploit “Respondent Banks” to Move Dirty Money 🚨

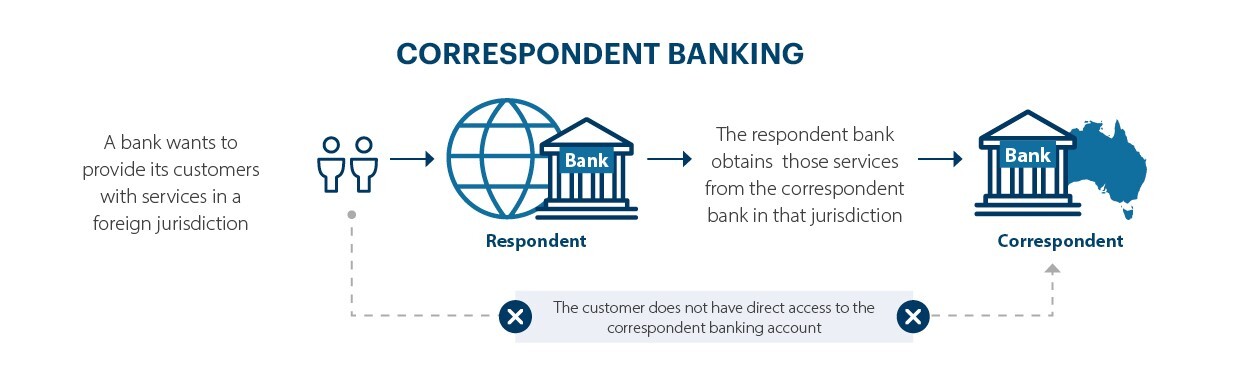

Did you know that some banks act as a “middleman” for other banks? These are called respondent banks—banks that rely on bigger “correspondent banks” to handle transactions for them, especially in different countries.

While this system helps move money globally, criminals love to abuse it. Here’s how:

🔹 Hiding Dirty Money – A drug cartel in Country A uses a small local bank (respondent bank) to send money to Country B. The big correspondent bank may not check deeply, letting illegal funds slip through.

🔹 Fake Businesses – Scammers set up fake companies in weak-regulated countries, then use respondent banks to move money, making it look like real business payments.

🔹 Avoiding Scrutiny – Some criminals pick respondent banks in places with loose rules, so their shady transactions go unnoticed.

Banks and regulators are fighting back with better tech like #InclusiveRegtech (fairer compliance tools) and #OpenSourceAML (transparent anti-money laundering systems). But we all need to stay alert!

📖 Learn more about financial crime terms here: [ACAMS Glossary](https://www.acams.org/en/resources/aml-glossary-of-terms)

#FinancialCrime #RespondentBank #MoneyLaundering #Compliance #100HariNulis