#QuickBiteCompliance Day 22

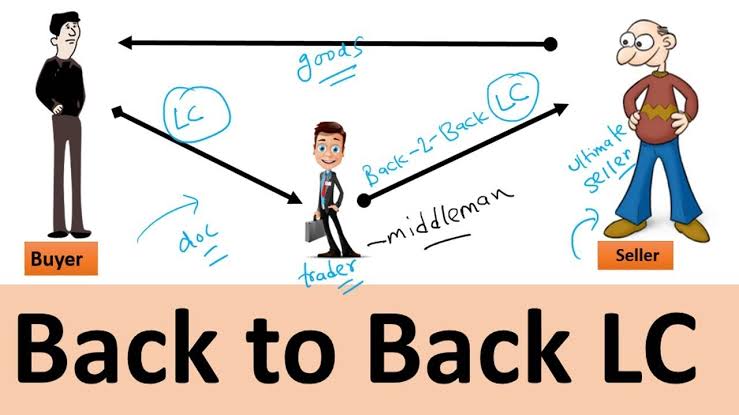

What is Back-to-Back Letters of Credit?

A form of financing in which Bank A issues a letter of credit as collateral to Bank B in order to issue a separate letter of credit to the beneficiary. This often happens when the underlying agreement between the applicant and beneficiary contains restrictions about the credit quality of the bank that is issuing the letter of credit, the location of the issuing bank, or other stipulations that prevent the applicant’s bank from issuing a direct letter of credit to the beneficiary. A sanctions evader can use a back-to-back letter of credit to remove the name of a sanctioned bank from the documentation.

#BackToBack #LetterofCredit #InclusiveRegtech

Source: https://www.acams.org/en/resources/aml-glossary-of-terms