#QuickbiteCompliance day 221

🔍 Risk Assessments: Your Business’s Superpower Against Financial Crime!

Think of a risk assessment like a superhero’s X-ray vision—it helps businesses spot hidden dangers before they become big problems. For banks and companies, it’s the secret weapon to stay safe from sanctions violations, money laundering, and fraud.

### 🕵️ How Do Criminals Exploit Weak Risk Assessments?

Bad actors love when companies don’t check for risks properly. Here’s how they take advantage:

– Fake Identities: Criminals use stolen or fake documents to open accounts at banks with weak customer checks.

– High-Risk Countries: They move money through places with weak sanctions enforcement, hiding illegal transactions.

– Complex Transactions: By splitting payments or using shell companies, they trick businesses into processing dirty money.

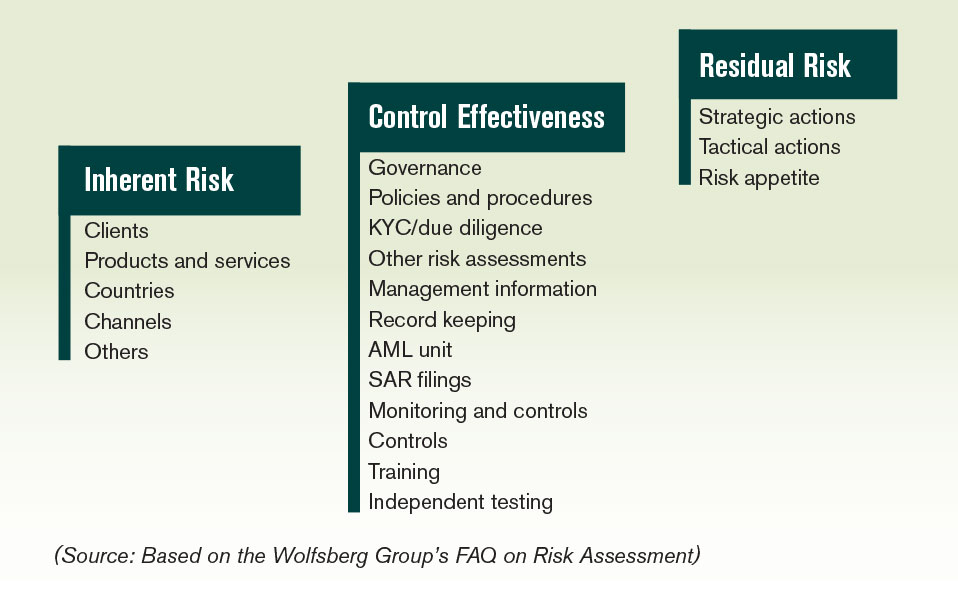

### 🛡️ How Can a Strong Risk Assessment Help?

1️⃣ Find Weak Spots – Like checking for unlocked doors before a thief does.

2️⃣ Fix Gaps – Adding better controls, like stricter ID checks.

3️⃣ Stay Smart – Updating risks as criminals change tactics.

The best part? Tools like #InclusiveRegtech and #OpenSourceAML make risk assessments faster, fairer, and more effective—helping businesses stay compliant without slowing down.

🚀 A good risk assessment = Fewer surprises + Safer growth!

📖 Learn more: [ACAMS Glossary of Terms](https://www.acams.org/en/resources/aml-glossary-of-terms)

#RiskManagement #SanctionsCompliance #FinancialCrime #AntiMoneyLaundering #InclusiveRegtech #OpenSourceAML #100HariNulis

(P.S. Inclusive Regtech & Open Source AML are key features of Mulai Console—helping businesses fight financial crime smarter!)