#QuickbiteCompliance day 230

🚀 Sanctions Due Diligence (SDD): Keeping Bad Guys Out of the Financial System!

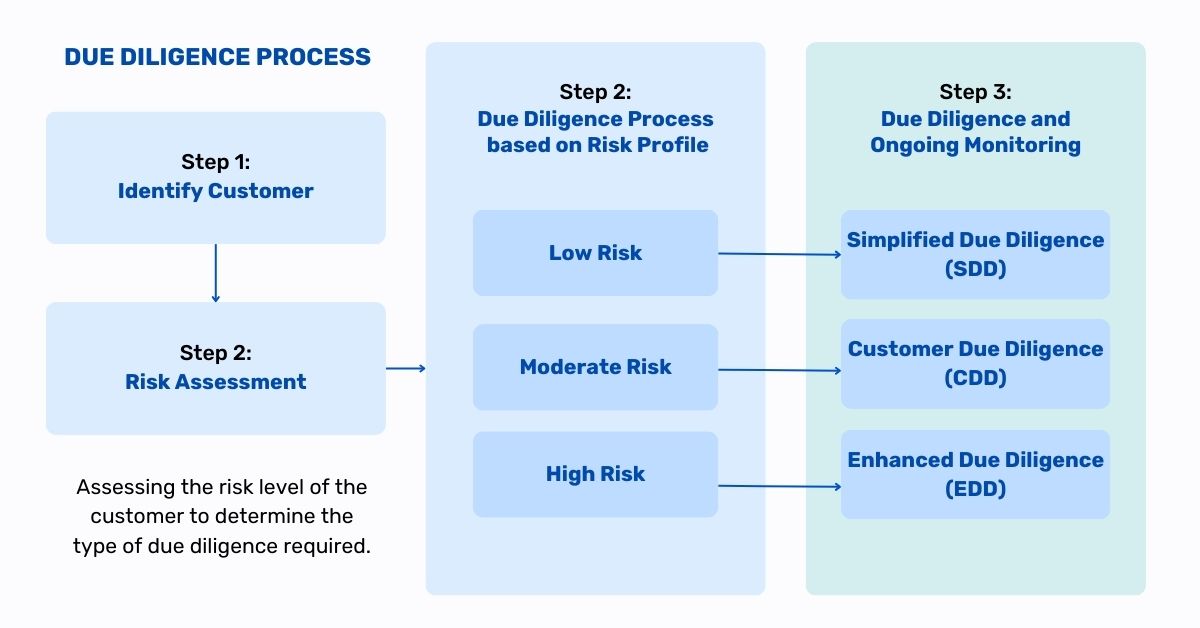

Did you know that just like banks check who you are before opening an account (KYC), they also have to make sure you’re not on a “bad guy list”? That’s called Sanctions Due Diligence (SDD)—a fancy way of saying “Are you allowed to do business with us?”

### 🔍 How Do Bad Guys Try to Trick the System?

Bad actors hide behind fake names, shell companies, or even innocent-looking businesses to move dirty money. For example:

– A criminal might use a front company in one country to avoid sanctions and secretly fund illegal activities.

– A corrupt official could pretend to be a relative of a sanctioned person to sneak money through banks.

– A terrorist group might use a charity as a cover to receive funds.

Without proper SDD checks, these criminals could slip through the cracks!

### ⚡ When Does SDD Happen?

– Onboarding (when you first join a bank)

– New products (like getting a loan or investment)

– Trigger events (if a red flag pops up)

– Periodic reviews (checking in regularly)

– Exiting (when the relationship ends)

By staying alert at every step, banks can stop bad guys from abusing the system.

### 🌍 Inclusive Regtech & Open Source AML

Tools like Mulai Console use smart tech (Regtech) and open-source solutions to make SDD & AML faster, fairer, and more efficient. Because fighting financial crime should be accessible to everyone!

📖 Learn more about AML terms here: [ACAMS Glossary](https://www.acams.org/en/resources/aml-glossary-of-terms)

#SanctionsCompliance #FinancialCrime #SDD #KYC #AML #InclusiveRegtech #OpenSourceAML #100HariNulis #StopIllegalFinance

(Like & repost to spread awareness! 💡)