#QuickbiteCompliance day 248

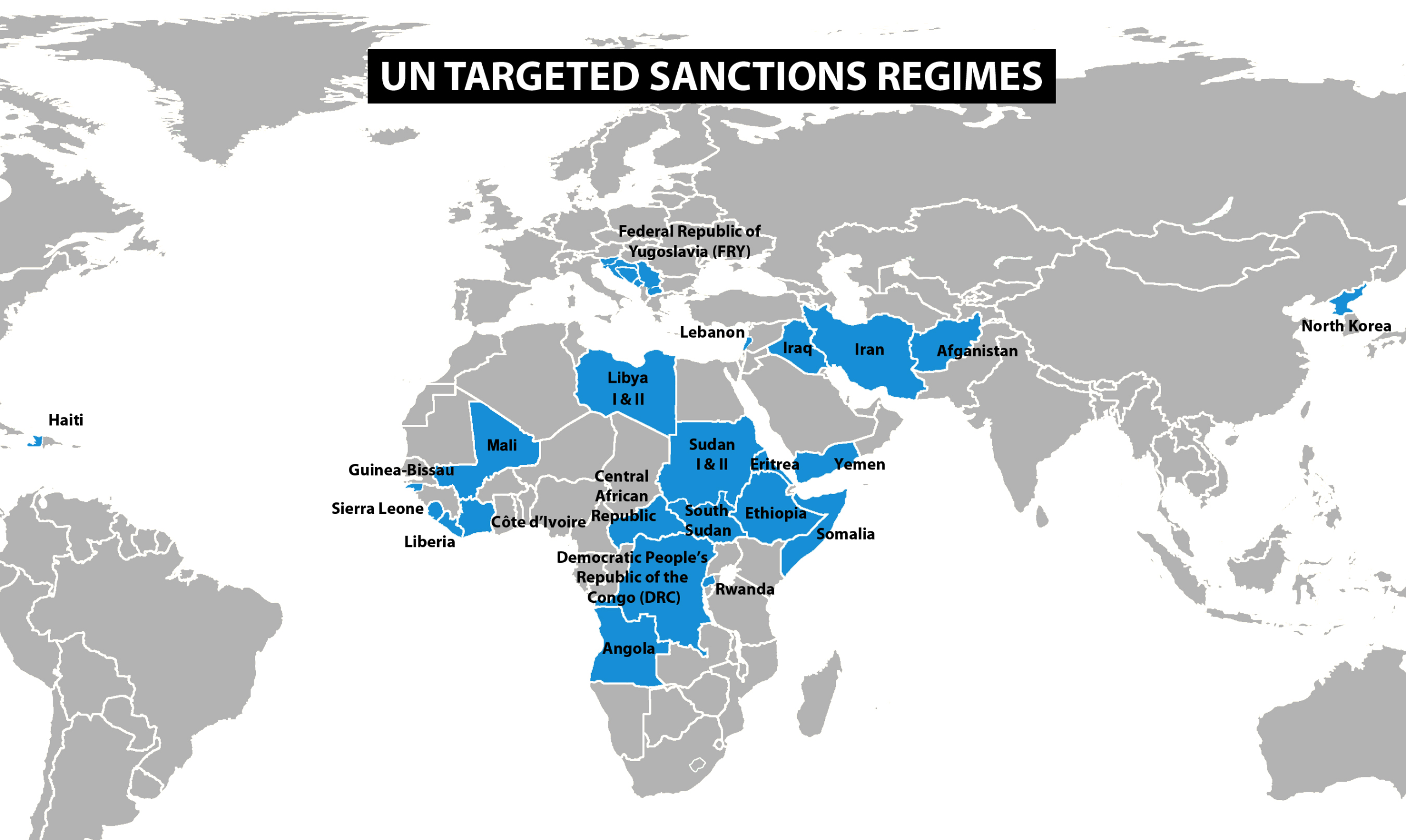

🎯 Bullseye Sanctions: Hitting Bad Guys Without Hurting Innocents

Imagine trying to stop a school bully by grounding the whole class. That’s what old-school sanctions did—punished entire countries. “Smart sanctions” (or targeted sanctions) are like a laser beam:

➡️ Freeze only the bully’s lunch money (asset freezes).

➡️ Ban only the bully from field trips (travel bans).

➡️ Stop only the bully’s snack supply (trade bans on specific goods).

🚨 How Bad Guys Cheat the System:

1. Shell Games: Oligarchs hide money by buying art, crypto, or shell companies in their cousin’s name. Example: A $1M yacht “owned” by a front company in Panama .

2. Third-Party Tricksters: Sanctioned banks use “friendly” banks in other countries to process payments. Like smuggling cash via a neighbor’s backpack .

3. Crypto Camouflage: Terror groups use privacy coins (e.g., Monero) or mixers to move funds—untraceable! .

4. Ghost Trade: Iran sells oil via “dark fleet” tankers that switch off trackers. Ship-to-ship transfers at sea = invisible oil .

💡 Fighting Smarter with #InclusiveRegtech & #OpenSourceAML:

– AI Sleuths: Machine learning scans ownership webs to find hidden links (e.g., a sanctioned CEO’s secret stake in a “clean” factory).

– Shared Blacklists: Open-source tools let banks globally share suspicious names—like a united neighborhood watch .

(P.S. This is why Mulai Console builds collaborative tech—so small banks can afford big compliance power!)

⚠️ Remember: Smart sanctions work best when we all aim together. Report suspicious patterns!

Source: [ACAMS Glossary](https://www.acams.org/en/resources/aml-glossary-of-terms)

Hashtags: #SmartSanctions #FinancialCrime #AML #Compliance #RiskManagement #InclusiveRegtech #OpenSourceAML #100HariNulis #FinTech #SanctionsEvasion

—

💬 Your turn: Seen clever sanction dodging? Share below! 👇