#QuickbiteCompliance day 258

Unmasking the Cookie Jar Trick in Money Laundering! 🍪💸

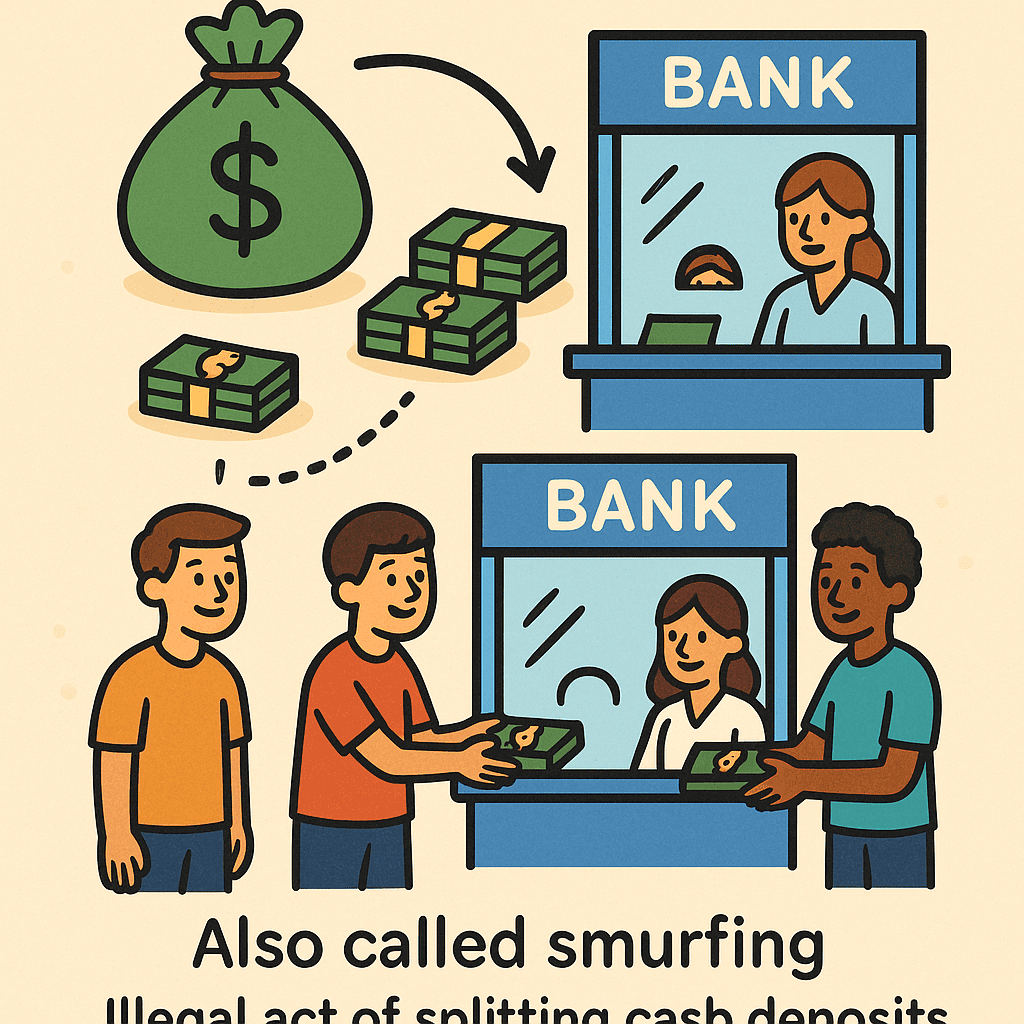

Ever seen someone sneak cookies by taking one at a time? Bad guys do the same with dirty cash! It’s called “Structuring” (or “Smurfing”)—a sneaky trick where criminals split big piles of cash into tiny deposits or withdrawals to fly under the radar. Here’s how it works:

👉 Example: Imagine a drug dealer has $50,000 in illegal cash. Instead of depositing it all at once (which would trigger a bank report), they break it into 5 deposits of $9,999 each over a week. By staying just below the $10,000 reporting rule, they hide the money trail!

🚨 Why it’s dangerous:

– Fuels crimes like drug trafficking, fraud, and terrorism.

– Tricks banks into moving “invisible” dirty money.

– Hurts everyone by making illegal profits look clean!

✨ The Good News: Tech is fighting back! With #InclusiveRegtech and #OpenSourceAML, tools like Mulai Console help banks spot these “cookie jar” patterns—no matter how sneaky the criminals get. By sharing smart, open-source solutions, we make finance safer AND fairer for all.

🌍 Let’s crush financial crime—one “smurf” at a time!

🔗 Learn more: [ACAMS Glossary: Structuring](https://www.acams.org/en/resources/aml-glossary-of-terms)

#FinancialCrime #AML #Structuring #Smurfing #AntiMoneyLaundering #Fintech #InclusiveRegtech #OpenSourceAML #100HariNulis #StayVigilant