by Tommy Hartono | Jul 7, 2025 | Terms

#QuickbiteCompliance day 261 🌟 Catch the Bad Guys: How Banks Spot Sneaky Money Moves! 🌟 Imagine your school principal notices kids trading candy in secret during recess. They’re hiding it because candy’s banned! 🍬 Banks do the same thing—but instead of...

by Tommy Hartono | Jul 5, 2025 | Terms

#QuickbiteCompliance day 259 Unmasking Financial Crime: The Subpoena Superpower! Ever get a surprise party invitation? Imagine one that forces you to show up—with your financial records! That’s a subpoena: a legal “must-appear” card from a...

by Tommy Hartono | Jul 4, 2025 | Terms

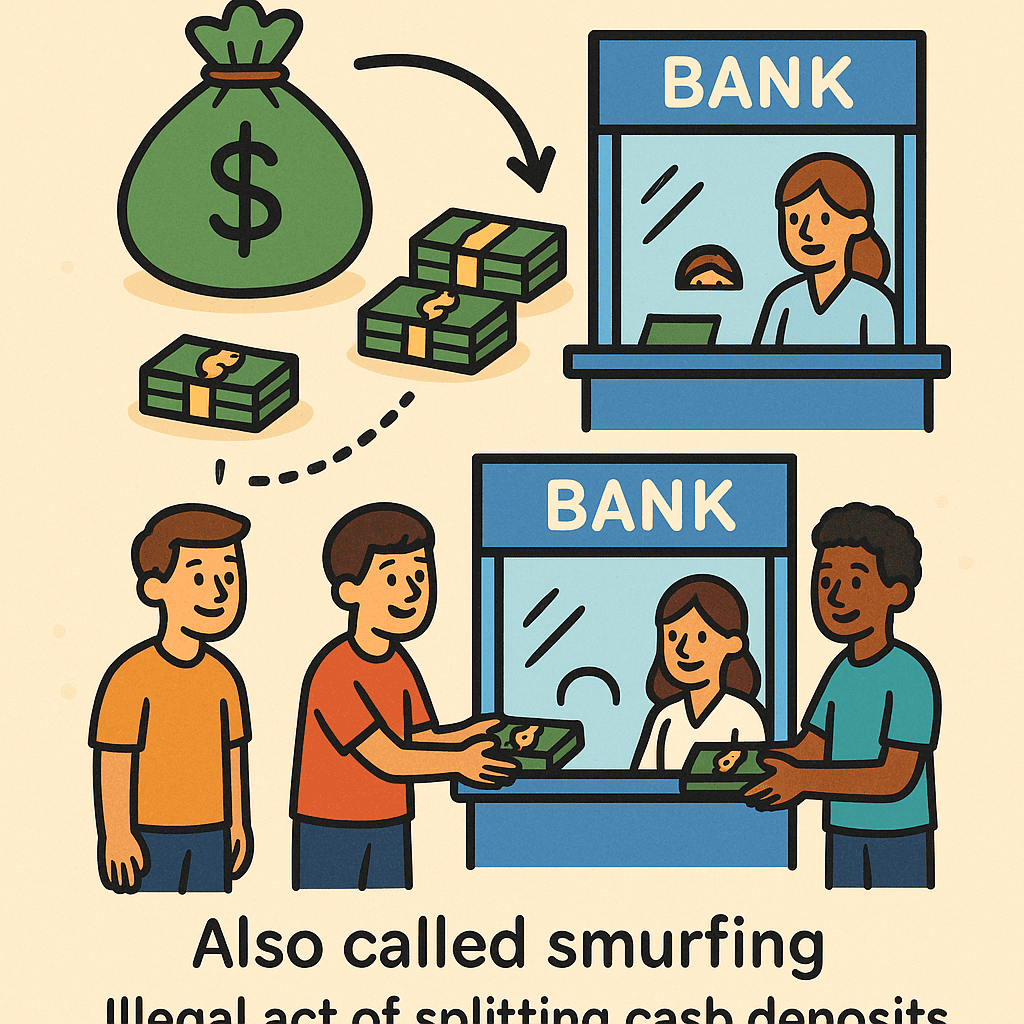

#QuickbiteCompliance day 258 Unmasking the Cookie Jar Trick in Money Laundering! 🍪💸 Ever seen someone sneak cookies by taking one at a time? Bad guys do the same with dirty cash! It’s called “Structuring” (or “Smurfing”)—a sneaky trick where...

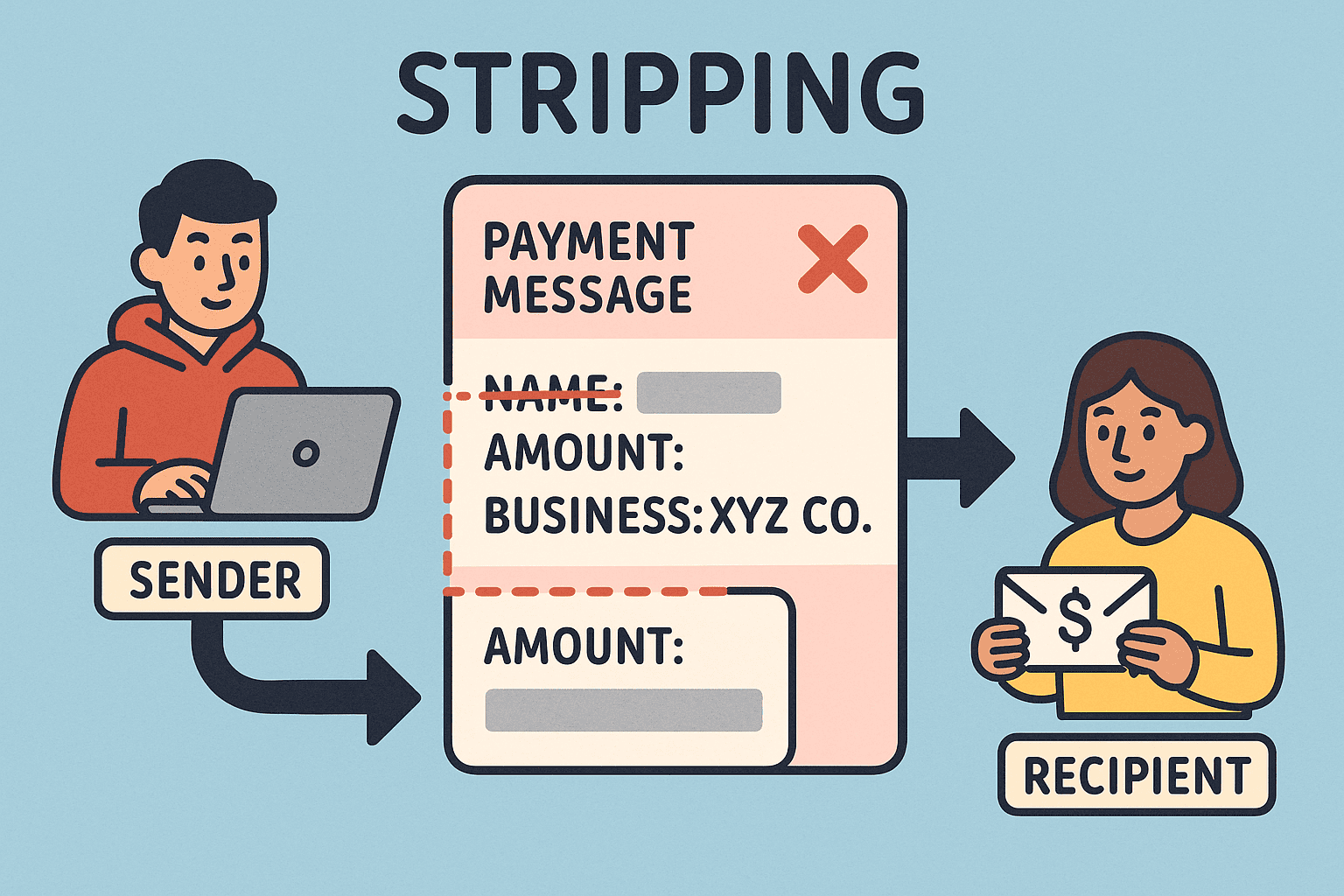

by Tommy Hartono | Jul 3, 2025 | Terms

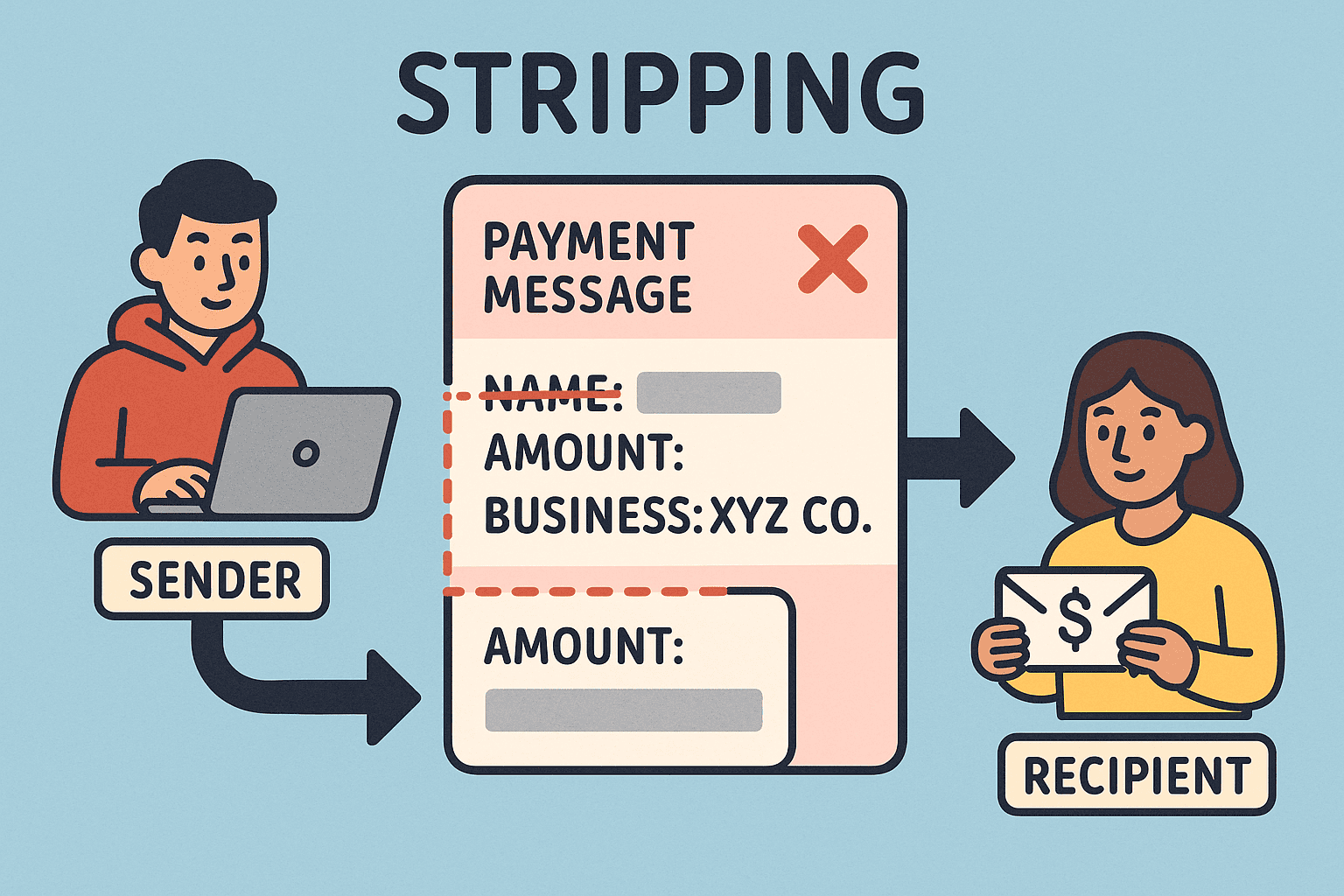

#QuickbiteCompliance day 257 🚨 The “Invisible Money” Trick: How Criminals Hide in Plain Sight Imagine sending a secret message where you remove the sender’s name and address so no one knows where it came from. That’s “Stripping”—a...

by Tommy Hartono | Jul 2, 2025 | Terms

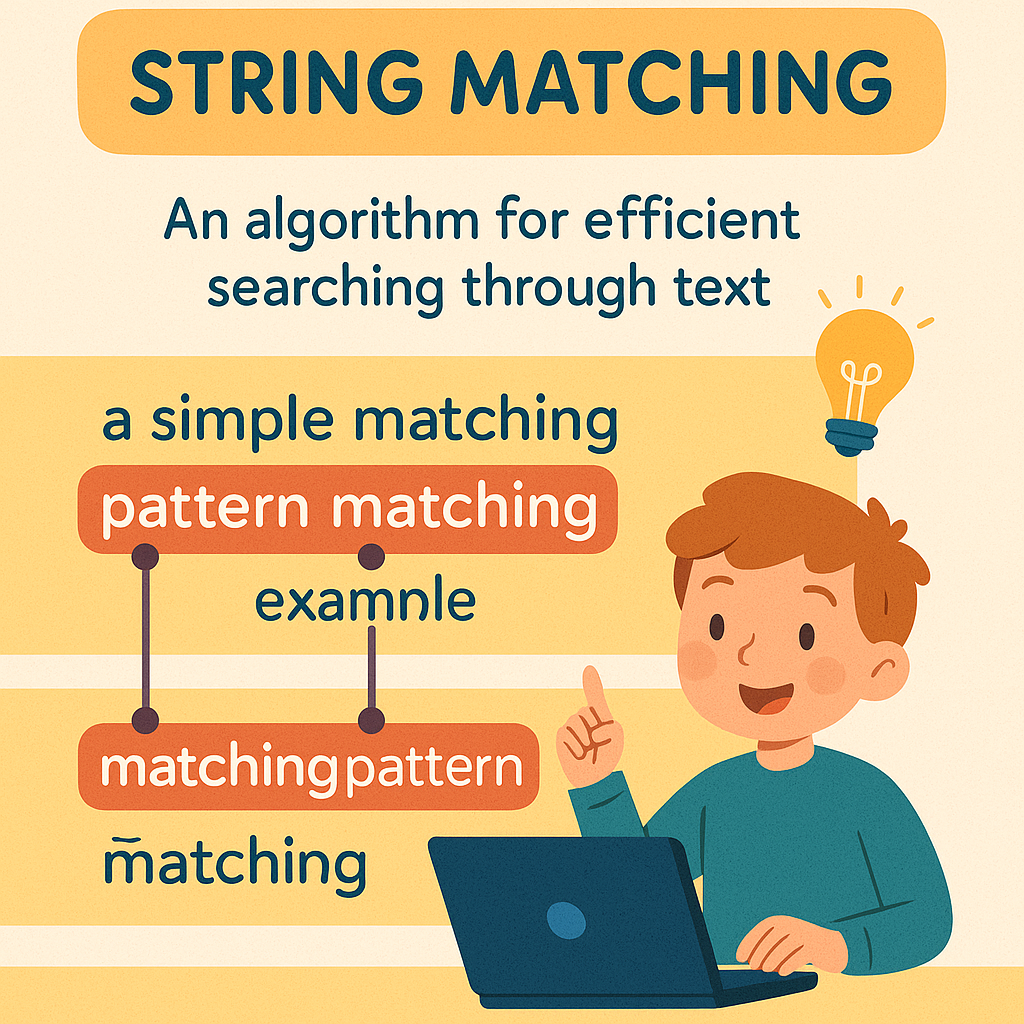

#QuickbiteCompliance day 256 🔍 The Sneaky World of String Matching & Financial Crime (and How We Fight Back!) Imagine playing “Where’s Waldo?” but Waldo changes his stripes every time you blink. That’s how financial criminals hide in...

by Tommy Hartono | Jul 1, 2025 | Terms

#QuickbiteCompliance day 255 🔍 The Invisible Rule That Traps Good Companies: How Criminals Exploit “Strict Liability” Imagine playing soccer where you get a red card—not because you broke the rules—but because someone on your team did. You didn’t...