#QuickBiteCompliance Day 193

🌍 Offshore Financial Centers: The Secret Hideouts of Dirty Money (Simplified!)

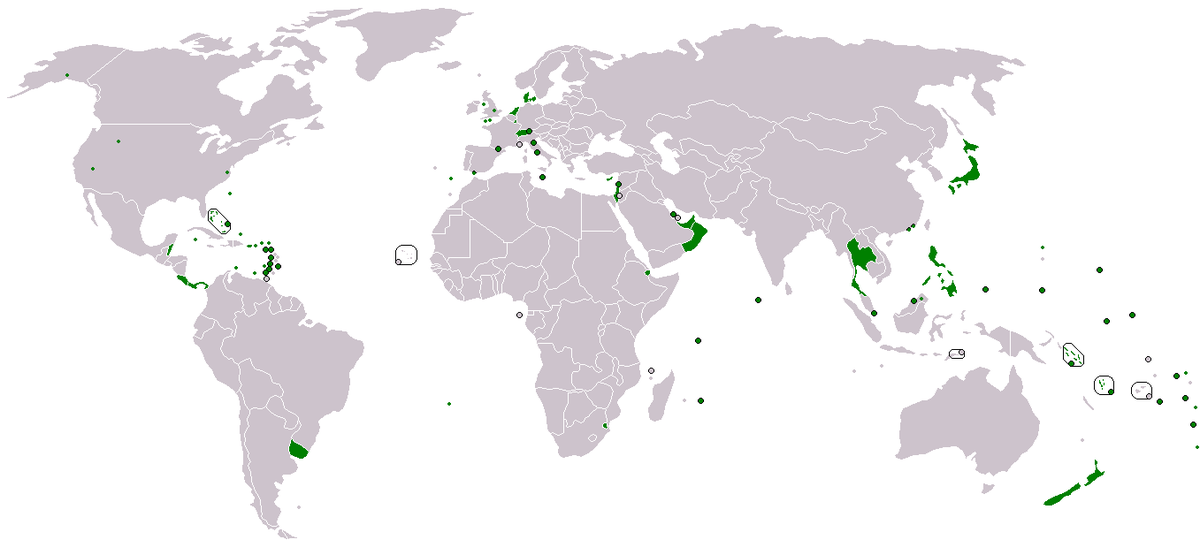

Imagine a secret hideout where bad guys stash their treasure, far away from cops and rules. That’s kinda what Offshore Financial Centers (OFCs) are like—places where companies and banks exist but don’t really operate locally. Think sunny islands near big countries like the U.S. or Europe. Sounds harmless? Not always.

Here’s how criminals abuse OFCs:

🕵️♂️ The Fake Company Trick

Bad guys create fake companies in OFCs to hide stolen money. For example, a corrupt politician steals $10 million from their country, then “invests” it in a shell company (like an empty box with a fancy name) in an OFC. The money looks “clean” because it’s “offshore,” but really, it’s stolen.

💼 The Money Laundry Machine

Dirty money from drugs or scams gets moved through layers of OFC companies. Picture this: A criminal in Country A sends cash to a fake business in an OFC, which then “sells” fake services to another fake business in a different OFC. By the time the money reaches a real bank, it looks like legit profit. Poof! Crime pays.

How do we fight back?

Tools like #InclusiveRegtech (tech that makes rules fairer and smarter) and #OpenSourceAML (free tools to track dirty money) are game-changers. They help banks and governments spot sneaky OFC tricks before the bad guys disappear.

💡 Stay curious, stay informed!

The more we understand OFCs, the harder it is for criminals to hide. Let’s make finance safer for everyone.

📚 Learn more about financial crime terms here: [ACAMS Glossary](https://www.acams.org/en/resources/aml-glossary-of-terms)

#InclusiveRegtech #OpenSourceAML #100HariNulis #FinancialCrime #TransparencyMatters

—

P.S. Inclusive Regtech and Open Source AML are key features of Mulai Console, helping businesses stay one step ahead of financial crime. 🌟