#QuickbiteCompliance day 233

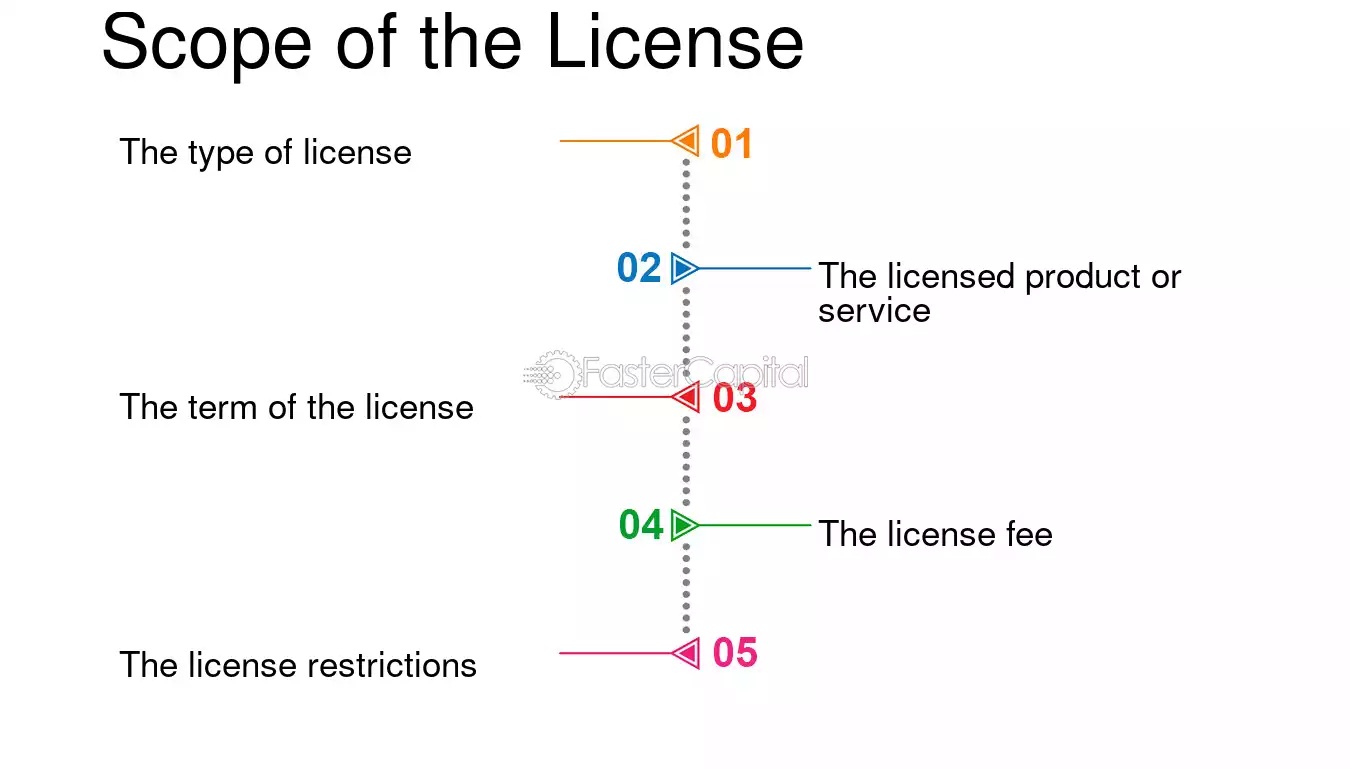

🔍 Understanding Licensing Scopes: Why It Matters in Fighting Financial Crime

Did you know that a company’s license determines exactly what it can and cannot do with your money? �💸

For example, if a firm is holding frozen assets (money that can’t be moved), can it transfer some to a creditor? Only if the license allows it! If not, bad actors might exploit gaps to move illegal funds.

### 🚨 How Criminals Abuse Licensing Rules:

– “Licensed to Hide” – Some firms claim broad permissions but secretly move dirty money under false pretenses (e.g., fake creditor claims).

– “The Shell Game” – Criminals set up fake businesses with “legitimate” licenses to launder money through seemingly legal transfers.

– “The Loophole Launderer” – If a license doesn’t specify strict transfer rules, fraudsters exploit the ambiguity to siphon funds.

✅ The Fix? Clear licensing rules + tech that tracks permissions in real-time (like #InclusiveRegtech & #OpenSourceAML tools!).

📖 Learn more about AML terms: [ACAMS Glossary](https://www.acams.org/en/resources/aml-glossary-of-terms)

#FinancialCrime #AMLCompliance #RegulatoryCompliance #Fintech #100HariNulis #StopMoneyLaundering

(P.S. Inclusive RegTech and Open Source AML are key features of Mulai Console—making compliance smarter and more transparent!)